Table of Contents

Atrial fibrillation (A-fib) is a severe condition that affects the heart and how it pumps blood. It is a type of arrhythmia, or irregular heartbeat, which can result in severe health complications such as stroke, heart attack, and congestive heart failure. A-fib has traditionally been considered a cardiovascular disease and is often classified as such for life insurance purposes.

Is A-fib Considered Heart Disease for Life Insurance?

Yes, atrial fibrillation (A-fib) is typically considered a form of heart disease by life insurance companies. This can affect underwriting decisions, potentially leading to higher premiums or modified coverage terms due to the increased health risks associated with the condition.

The increase in insurance premiums for individuals with atrial fibrillation (A-fib) varies widely and depends on several factors. These factors include the severity and control of the A-fib, the individual’s overall health, age, lifestyle, the specific insurance company’s policies, and the type of life insurance being applied for. Generally, having A-fib can lead to higher premiums due to the increased risk of heart-related complications. Still, the insurance provider can only determine the exact increase amount during the underwriting process.

I will provide your example:

- Baseline Premium for a Healthy Individual:

- Age: 45 years

- Non-smoker

- No pre-existing health conditions

- Insurance premium $107

- Premium for an Individual with A-fib:

- Same age, smoking status, and insurance coverage

- Diagnosed with A-fib, controlled with medication

- No other major health issues

- Increased Risk Assessment by the insurer

- Estimated average Monthly Premium: $169

Analysis:

- The individual with A-fib faces a premium of 50% to 100% higher than a healthy individual of the same age and coverage terms.

- This increase reflects the higher risk associated with A-fib, which can lead to more severe heart conditions and other health issues.

- The exact premium depends on the insurer’s assessment of the risk, the severity of the A-fib, and how well it is managed.

Key Points:

- Variability: Actual premium rates vary significantly between insurance providers and depend on detailed medical evaluations.

- Shopping Around: It’s beneficial for individuals with A-fib to compare quotes from multiple insurers to find the best rates.

- Other Factors: Factors like age, overall health, lifestyle habits, and the type of life insurance policy also play a significant role in determining premiums.

See case study analysis:

| Rate Classification | Age | Male $100,000/20-Year | Female $100,000/20-Year | Male $250,000/20-Year | Female $250,000/20-Year | Male $500,000/20-Year | Female $500,000/20-Year |

|---|---|---|---|---|---|---|---|

| Standard | 40 | $19.14 | $16.90 | $34.22 | $30.31 | $62.94 | $54.53 |

| Substandard – 50% over Standard | 40 | $24.66 | $21.36 | $43.75 | $36.13 | $79.38 | $65.76 |

| Substandard – 100% over Standard | 40 | $31.05 | $26.64 | $56.50 | $46.23 | $103.91 | $85.74 |

| Substandard – 150% over Standard | 40 | $37.36 | $28.43 | $67.60 | $56.55 | $126.51 | $98.72 |

| Standard | 50 | $39.23 | $30.50 | $81.18 | $61.28 | $150.77 | $116.50 |

| Substandard – 50% over Standard | 50 | $51.68 | $40.93 | $103.02 | $76.83 | $196.55 | $144.09 |

| Substandard – 100% over Standard | 50 | $67.06 | $52.73 | $135.51 | $99.36 | $260.13 | $190.19 |

| Substandard – 150% over Standard | 50 | $82.88 | $63.47 | $160.08 | $121.59 | $308.46 | $232.07 |

| Standard | 60 | $96.44 | $68.90 | $214.94 | $150.68 | $412.35 | $287.58 |

| Substandard – 50% over Standard | 60 | $132.30 | $90.40 | $263.98 | $184.62 | $517.39 | $354.58 |

| Substandard – 100% over Standard | 60 | $174.56 | $118.70 | $350.04 | $244.23 | $687.91 | $470.84 |

| Substandard – 175% over Standard | 60 | $206.49 | $143.57 | $423.37 | $299.87 | $835.03 |

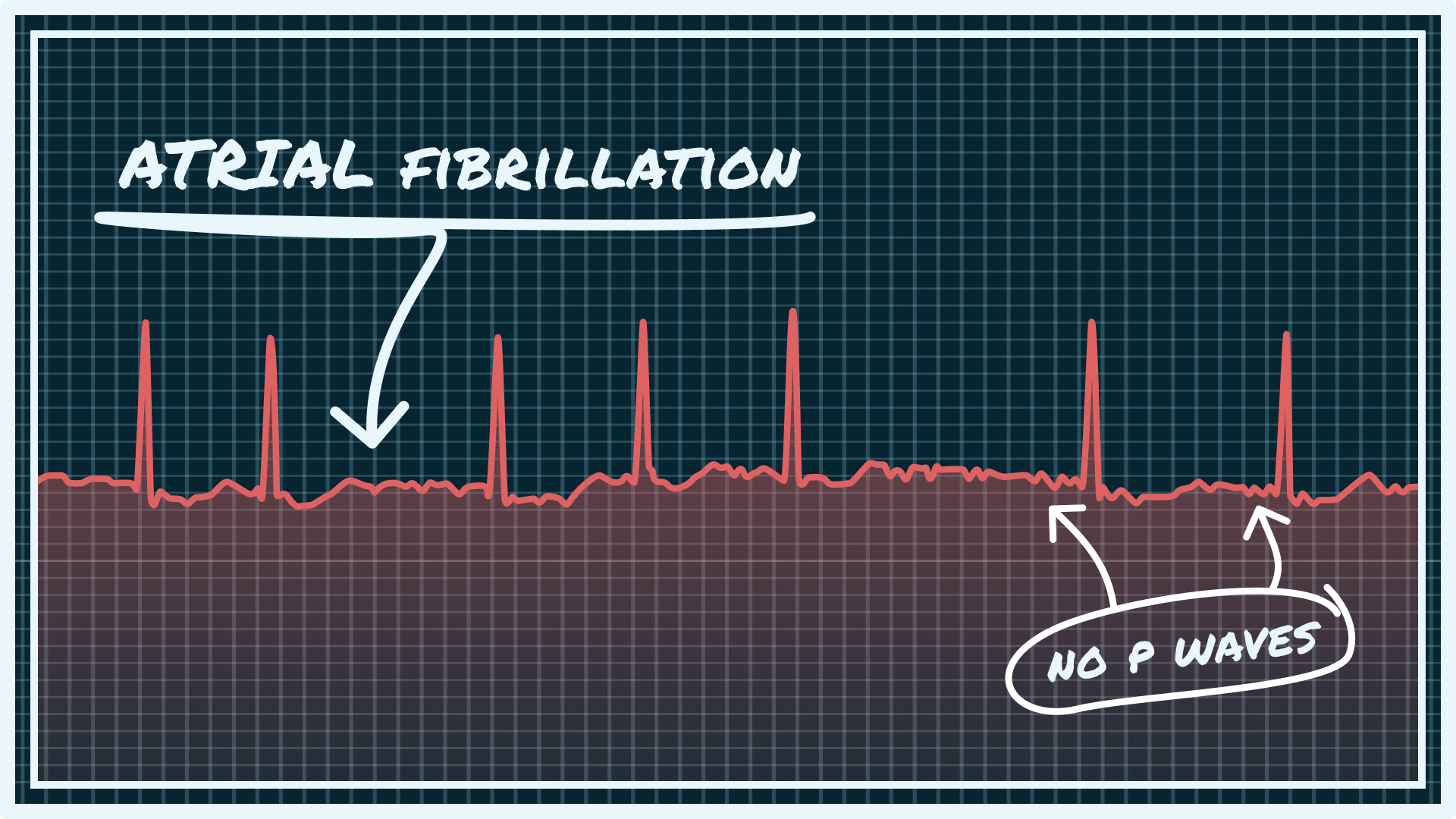

For those unfamiliar with A-fib, it is an electrical disorder of the heart where the normal rhythm of the atria (the upper chambers) becomes abnormally fast and chaotic. This chaotic rhythm causes the atria to contract rapidly and irregularly, resulting in a condition known as fibrillation. Depending on the severity, this raised rate of contraction can cause symptoms such as dizziness, fatigue, lightheadedness, and chest pain. In more severe cases, A-fib increases the risk of stroke due to blood clot formation in the chambers of the heart.

Atrial fibrillation (A-fib) is often considered a form of heart disease by life insurance companies. Here’s how this typically works in the context of life insurance:

- Definition and Risk Factors: A-fib is an irregular and often rapid heart rate that can increase the risk of strokes, heart failure, and other heart-related complications. It’s categorized as a type of cardiac arrhythmia and is a common form of heart disease.

- Impact on Life Insurance Applications: When applying for life insurance, applicants must disclose their medical history, including heart disease diagnoses like A-fib. This information is critical for underwriting, where the insurer assesses the risk of insuring an individual.

- Underwriting Considerations: Insurers will consider several factors related to A-fib, such as the severity of the condition, how well it’s managed (e.g., through medication or lifestyle changes), the presence of any related health issues (like high blood pressure failure), and the overall health of the applicant. These factors help determine the risk level and thus impact the premiums and policy terms.

- Premiums and Coverage: Individuals with A-fib might face higher premiums due to the inessentials associated with the condition. In some cases, insurers might limit the coverage or exclude specific conditions related to A-fib. However, the specifics can vary significantly between insurance providers and depend on the individual’s long-term status.

- Possibility of Rejection: Some insurers might decline coverage in severe cases or if the A-fib is poorly managed. However, this is not always the case, and many individuals with A-fib successfully obtain life insurance.

- Specialized Insurance Providers: Some insurers specialize in high-risk applicants, including those with heart conditions like A-fib. These specialized providers might offer more favorable terms or specific policies tailored for individuals with such health issues.

It’s essential for individuals with A-fib seeking life insurance to shop around, compare offers from various insurers, and possibly consult with an insurance agent who can guide them through the process and help find the best coverage options for their situation.

When applying for life insurance coverage, applicants must disclose any medical conditions so their insurer can properly assess their risk factors before issuing coverage. As A-fib is considered a cardiovascular disease by many organizations (including most major health insurers), applicants may be asked to provide information regarding any existing A-fib diagnosis. The insurer will then assess your risk factors based on your medical history and lifestyle before deciding whether or not to offer you coverage.

Those with a history or diagnosis of A-fib may find themselves paying higher premiums than those without the condition because they are seen to pose an increased risk when it comes to death by natural causes. However, this does not necessarily mean that individuals will be declined coverage altogether; many people with controlled A-fib can still receive life insurance coverage after passing specific eligibility requirements set by insurers. It’s essential for anyone seeking life insurance coverage to be honest about their medical history during the application process so that they are not penalized later on should a claim be made against their policy.

It’s also essential for people with A-fib to take steps towards keeping their hearts healthy through lifestyle changes such as exercising regularly and eating a balanced diet. Making the changes can help control symptoms and reduce risks associated with long-term complications such as stroke or heart attack—both of which can drastically reduce one’s life expectancy if untreated or mismanaged over time.

In conclusion, while there may be some added costs associated with life insurance after being diagnosed and following any treatment regimens, your doctor requires quality coverage, provided all relevant information relating to one’s health status has been disclosed accurately during the application process. Taking steps towards managing one’s overall health through proper exercise can also help individuals better manage their condition long term while reducing related risks significantly – making attractive prospects for insurers when considering life insurance applications from people living with atrial fibrillation (A-Fib) essential and life insurancetreatmentHeart Disease for Life Insurance.

Heart disease is a severe and life-threatening condition that affects millions of people around the world. It is the leading cause of death among adult men and women in the United States. While many treatments are available to help manage and control heart disease, they are not always effective in preventing its progression or improving life expectancy. Therefore, it is essential to understand how heart disease is treated for life insurance purposes. Companies often require detailed medical information before issuing a policy for those with pre-existing heart conditions. This includes recent test results, such as EKG recordings, cholesterol levels, blood pressure readings, and cardiac treadmill tests. Additionally, applicants may be asked to provide a detailed description of their current state of health, including lifestyle habits such as diet and exercise routines that could affect their risk of developing heart problems in the future.

In cases where an individual has been diagnosed with a particular form of heart disease, life insurance companies may request additional testing or documentation from a doctor regarding the severity of the condition and expected prognosis. Depending on this information, some carriers may still offer coverage at an increased premium rate or with certain restrictions on coverage limits or other benefits included in the plan.

The proper treatment plan can make all the difference in living with heart disease and maintaining good health overall. That’s why keeping up with regular check-ups and closely following any treatment regimens your doctor prescribes is essential. Taking medications as directed can help reduce symptoms associated with certain heart conditions while helping lower blood pressure and cholesterol levels when appropriate. Additionally, lifestyle changes such as quitting smoking, eating healthy foods, exercising regularly, and reducing stress can improve cardiovascular health.

For those who have already been diagnosed with a particular form of heart disease – especially if symptoms are severe – it is essential to discuss all available treatment options with your physician or cardiologist before pursuing any form of life insurance coverage. Doing so will ensure you have all the relevant information necessary for proper consideration by your potential insurer before signing up for any plan or policy offered through them. Furthermore, this will enable you to make more informed decisions about which type of coverage best suits your needs now and in the future should your condition require additional care or management.