Clonidine is a medication used to treat high blood pressure, attention deficit hyperactivity disorder (ADHD), and some types of pain. It is also used to help reduce symptoms of alcohol withdrawal, hot flashes from menopause, and cancer treatments such as chemotherapy. The primary ingredient in Clonidine is clonidine hydrochloride. This medication works by blocking certain natural substances in the brain that can cause an increase in blood pressure.

How Much is Clonidine Without Insurance?

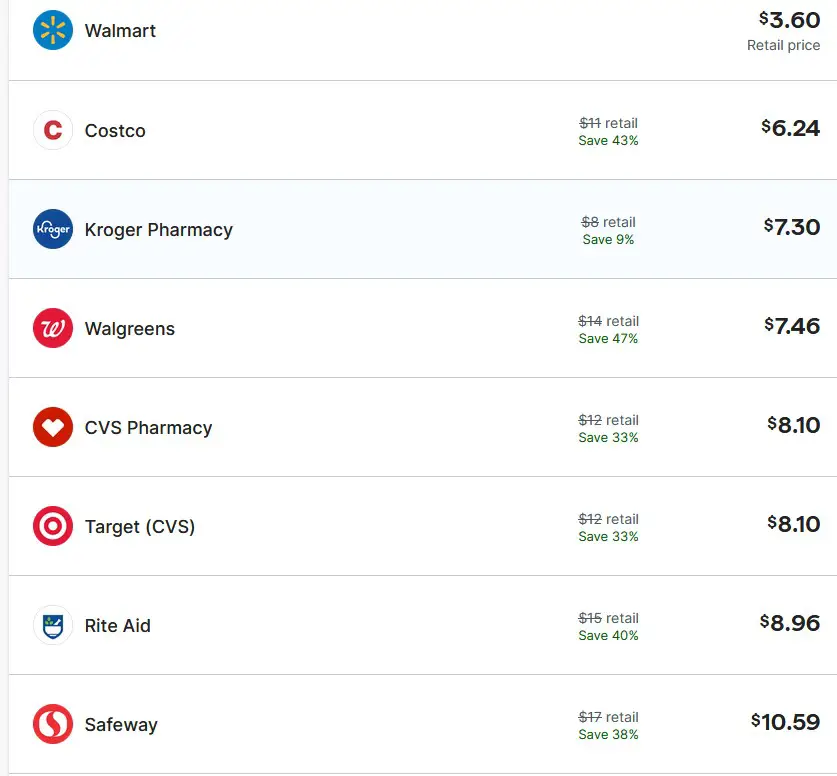

Clonidine’s price, without insurance, varies from $3.6 to $11, depending on where you purchase the medication. For example, at Walmart, generic Clonidine 0.1 mg costs approximately $4- $7 for 30 tablets. The exact quantity costs around $9 for 30 tablets at CVS Pharmacy. However, your copay may be lower than the above price if you have health insurance coverage. Additionally, many pharmacies offer discount programs or coupon codes, which could help reduce costs.

Clonidine price changes each day, depending on the day of the promotion in the week.

See below the price for 2023:

At online pharmacy websites like GoodRx or WellRx, you can find discounts ranging from 10-80% off regular prices of generic Clonidine without insurance coverage. Furthermore, some states have programs that provide prescription drug assistance to individuals who qualify based on income level and other criteria — this could be helpful if you do not have health insurance coverage or have a high-deductible health plan. Before purchasing Clonidine online or through any other channel, consider all prescription costs, shipping fees, and taxes when looking for the best deals.

In summary, it is difficult to determine how much Clonidine costs without insurance because prices vary depending on where it is purchased and whether discounts or coupon codes are available when ordering online. However, considering there are several ways to save money on this medication even without having health insurance coverage makes it worth exploring all options before making a purchase decision – including taking advantage of discount programs or coupons available from many pharmacies both online and offline as well as inquiring about prescription drug assistance programs offered in certain states to low-income individuals who meet specific criteria set forth by those states’ governments.