Much confusion has been created about George Soros, Progressive Insurance, and its relativity. One of the allegations was that George Soros owned a Progressive Insurance corporation.

Does George Soros own Progressive Insurance?

No, George Soros does not own or control Progressive Insurance. The accusations arose because Peter Lewis, who was chairman of Progressive Insurance, was a friend and ‘political associate’ of George Soros. However, all allegations are unfounded. “oros, “Progressive Al, “dance,” and “Progressive Insurance Corpo “action” are similar terms people often mix.

GSoros’so” os’s “Progressive Al “dance” and Lewis’se” is’s “Progressive Insurance Corpo “action” are separate entities with distinct purposes and ownership.”

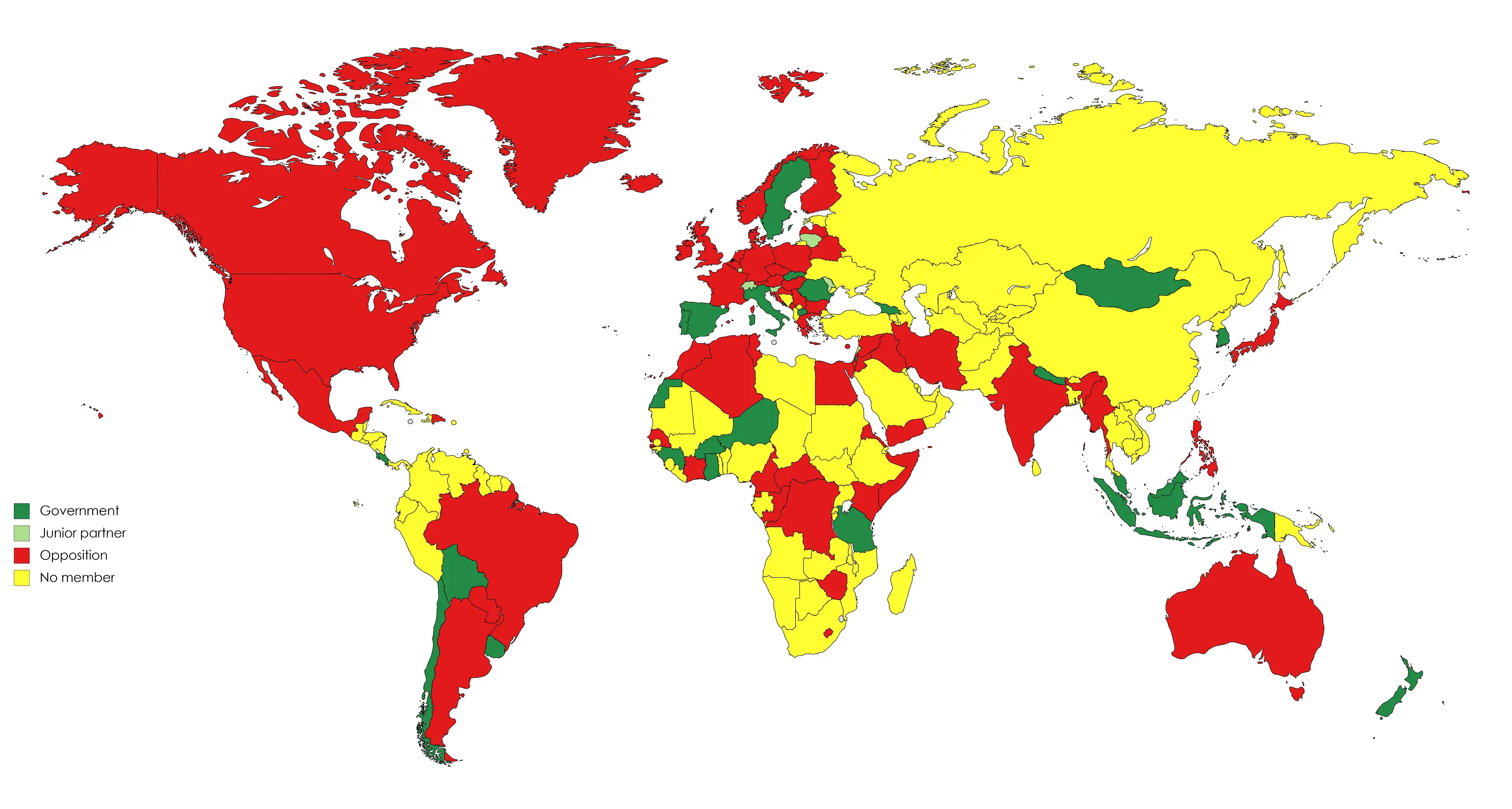

The “Progressive Al “dance” is a political organization founded by George Soros in 2013. Its mission is to promote progressive policies and ideas worldwide, including human rights, democracy, and climate change. The organization supports political candidates and advocacy groups aligned with its values and beliefs.

On the other hand,” Progressive Insurance Corpo “action is an insurance company founded by Peter Lewis in 1937. The company is known for its auto insurance policies and progressive policies, such as offering discounts for drivers who use less gasoline and supporting LGBT rights. The company is not associated with George Soros in any way.

There is a common misconception that George Soros “owns “Progressive Insu” ance.” This is likely due to the similar-sounding names, and Soros and Lewis are known for their progressive political beliefs. However, the two entities are entirely separate, with no connection.

Looking for Progressive and George Soros, you can find many stories of” the “Progressive Mov” ment,” beginning with George Soros, presumably because it has been quoted out of context. All of these allegations are possibly inspired by rivals recognizing that circulating speculation on social media will also persuade buyers to purchase goods based on cost and product only.

George Soros has a foundation called” The Progressive All “ance. Because of this name, people often mix the two similar terms.

Soros founded the Progressive Alliance, a political organization that gathered social democratic and progressive political parties.

However, this political organization and the Progressive Corporation are two different entities.

Progressive Corporation Company Review

If you have experience buying a car or are planning to get one, one of the things an auto broker has to explain to you is the progressive insurance policies attached to the product you are buying. Insurance helps you in financial trouble during unforeseen minor or major car accidents. One famous insurance company” y is “The Progressive Corporation,” which offers insurance to passengers of automobiles such as cars, motorcycles, boats, RVs, and other vehicles.

They also offer insurance for your house, pets, life, and different types of insurance as long as the company is connected to them. They are focused on making sure that you are covered and protected. Proof of their hard work and quality is their third-largest insurance company and the number one auto-insurer company in the United States. The company’s main office is in Mayfield Village, Ohio. It would not have been successful without the excellent works of Jack Green and Joseph M. company’s founders in 1937. As of 2021, the company became America’s Top Corporation, gaining the 74th spot on the 500 Fortune List.

The founding Leaders, Joseph Lewis and Jack Green, founded “The Progressive Insurance C “company” around 1937. In 1956, the company’s first original goal was to offer risky driver insurance. To start this business, Peter B. Lewis, JLewis’sewis’s son, with his mother, used a $2.5 million borrowed money as a security deposit to ensure the majority shares of the company and ultimately bought it. As people signed in with the insurance, they hit the $1 billion mark in 1987.

Since then, they have continued to be on the top of their game and reached the $20 billion mark. To continue progress, they embrace innovativeness in many ways, like being the first auto insurance company to transform traditional purchasing payment of insurance policies online through their website—furthermore, they society’s modernization by allowing purchases through mobiles and smartphones with 24/7 service.

Like any big company, it must ensure that the business runs smoothly. They have divided the company into three parts to ensure business operation efficiency. These are the following:

This part of the business focuses on drafting policies highlighting insurance for privately owned automobiles and vehicles directly or indirectly through the help of an independent law agency to cover all legal aspects of the guidelines.

Suppose businesses own a vehicle through the help of agency channels and are subjected to physical damage. In that case, the liabilities concerning these policies are the focus of this second section.

This section focuses on offering professional indemnity insurance to customers of banks, directors, and insurance liability for officers. It also provides Commercial Auto Insurance in 25 other states, securing its 164th spot in the Fortune 500 in 2011.

Other than modernizing insurance purchasing options, they also embrace television marketing to explain the benefits of using progressive insurance. They created Flo, Messenger, a humanized box, Flobot, Mara, Dr. Rick, and Mataur as the company’s face for endorsement. Through these characters, they advertise their different insurance policies for motorcycles and boats. Furthermore, to expand their marketing strategy, they started sponsoring automobile shows and other outdoor activities that their service can cater to.

Like any company, they also have their fair share of legal battles: lawsuits for privacy, policy problems, advertising problems, and insurance battles. Some of these are allegations, while the court deems others valid, and they already face the consequences.

The company still offers progressive insurance to help customers deal with problems. It is reportedly active with a total income of US$5.704 billion (2020) and supportive 43,000+ (2021) employees, making sure to offer the best progressive insurance you can get to protect yourself and your family.

Progressive Insurance Corporation does not have any relation with George Soros.