Table of Contents

The expense of vehicle insurance for an 18-year-old is not that distinguished first from the cost of vehicle insurance for any youngster. Whereas 18 is an essential achievement in any human’s life in the form of current legal chances, vehicle insurance will always be more costly than it would be at later stages as long as none of those certain subscription fee factors become out of control.

Gain knowledge of how much insurance coverage an 18-year-old needs. Adding a learner driver to one’s car insurance policy can be eye-opening. Younger drivers have the highest insurance premiums of any bracket, but they have almost no driving dynamics and are highly susceptible to more high vehicle behavior as a collective. Nevertheless, because high schooler insurance premiums are high, it somehow doesn’t mean that it is not cheap, particularly costly for an 18-year-old. There are also several options available to parents to lower the cost of healthcare for their newly licensed drivers.

Vehicle insurance for an 18-year-old is quite expensive compared to average rates for many other age categories. As for the website CarInsurance.com, those aged 16- and 17-years will expect to be paid $5700 yearly for health care coverage if they have their legislation with responsibility boundaries of 100/300/100. Furthermore, this figure can be significantly decreased, and perhaps the most popular way is for the family to add their young driver to their established insurance contract. Furthermore, recognizing the average earnings helps understand the range of cost possibilities.

Can an 18-Year-Old Get Their Car Insurance?

Yes, an 18-year-old is legal enough to get car insurance. Most states in the United States require drivers to be 18 and above. Erie Insurance Company has the cheapest insurance for 18-year-olds, at only $3,200 on average.

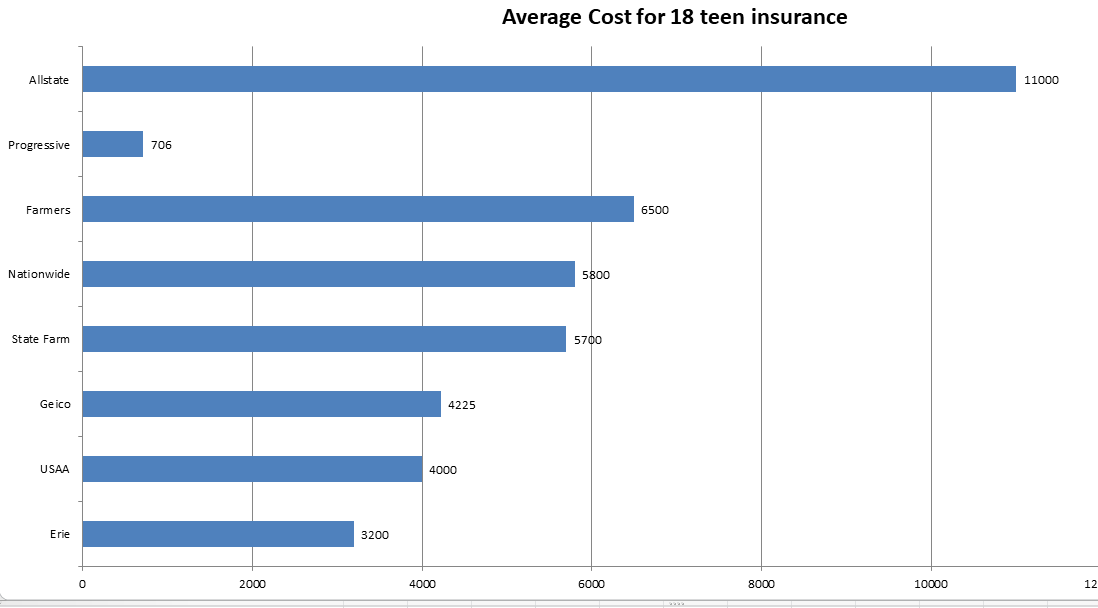

The average cost of car insurance for 18 years old in 2022:

| Insurance company | Average Cost for 18 teen insurance |

|---|---|

| Erie | 3200 |

| USAA | 4000 |

| Geico | 4225 |

| State Farm | 5700 |

| Nationwide | 5800 |

| Farmers | 6500 |

| Progressive | 706 |

| Allstate | 11000 |

Whenever it comes to employment, so every state has its necessities. A few more conditions do not necessitate health care coverage, whereas many others involve a certain level of coverage before a driver can legally operate a vehicle. However, if you consider benefiting from various discount coupons, actual states will force you to pay a significant amount if you have no choice. This is particularly true in states where the minimum standards are higher than the median annual premium. Mississippi, Michigan, Texas, Connecticut, and New York have the highest insurance costs for 18 – 24 years. Even though Michigan is broadly renowned for providing the highest total premium increases, Mississippi appears to take an unexpected lead in this category.

Aside from the jurisdiction and general geographic area, several more factors have influenced insurance rates for 18-—to 24-year-olds. Teenage boys, in particular, are generally more expensive to protect than young females. While both lack driving expertise due to their youth, young males are substantially more likely to be involved in accidents. Whenever a thorough vehicle history is lacking, insurers always examine this information.

Knowing that most companies look back four years for an active account, an 18-year-old has just two years of expertise, so pointing to statistics is unavoidable. Credit record, relationship status, and degree of education are also considered. Remember, many 18-year-olds seldom take advantage of these variables due to inexperience. However, data suggest that those wedded, have decent credit, and have an education are less likely to be involved in an accident. Because 18-year-olds have no driving history, insurers will always determine premiums based on total data.

Adding a young driver to a current regulation — generally their mothers’ — is among the most popular methods to cut the cost of a teenage vehicle’s insurance coverage. The 16- and 17-year-olds must live at home or attend university away from family and friends to be insured under their parent’s coverage. The expenses of adding the adolescent to the family’s current insurance will be significantly cheaper than separate insurance for the adolescent. Nevertheless, there are certain dangers to enrolling an 18-year-old in an insurance contract, so bear them before proceeding. If an 18-year-old gets involved in a collision or receives an infraction, as adolescents are statistically more prone to do, everyone else’s coverage premiums may rise.

Furthermore, the losses produced by a teen’s injury may occur beyond the provisions in place of the guardians. If this happens, the parents’ assets may be jeopardized. Due to the expense of an 18-year-old vehicle’s healthcare insurance, regardless of whether it was grouped, it’s time to take stock of any available discounts. Thankfully, there are several options for which many 18-—to 24-year-olds will be eligible.

18 – 24-year-olds enrolled in the program, either junior high or university, may be entitled to rebates if they keep a 3.0 GPA. Underwriters view children with academic academics as far more trustworthy and thus less of a danger. Other deals may be bailable if a young driver pursues further driving instruction above the basic license standards. Several companies get their classes, for which they provide discounts. Meanwhile, almost every insurer provides rebates for any cautious driving school because they may significantly reduce risk.

What is the Average Monthly Cost of Car Insurance For an 18-Year-Old?

The average monthly car insurance for an 18-year-old may cost between $550 and $650 for full comprehensive coverage.

What Type of Car Insurance Do I Need as a Student?

The type of car insurance that may be best for a student in college may be good student discounts. Most insurance companies offer reasonable rates for college drivers. After discounts, insurance costs may be around $400 monthly. But a student must be good at school and have good grades. Students with bad grades may not qualify for good student discounts.

Many insurance carriers offer additional savings to children who study college away from family and friends. This will usually need some form of evidence, and the place must be much more than 100 miles from the nearest town. If you keep most of these considerations in mind, you’ll be in a much stronger position to locate a 16- and 17-year insurance plan that provides both cost and protection. Just keep in mind that price comparisons are usually a good idea. Since all health insurers use the same elements when developing estimates, those considerations are not weighted equally.

Some automobile insurance reductions are exclusively available to inexperienced drivers. In contrast, most insurance firms provide actual printable coupons. Students with a B grade or above are eligible for GEICO reduction. However, because each business will have its own list of expectations, it is critical to verify with your provider to determine the qualifications for excellent student discounts. The “With off At College” deal is another frequent discount many insurance carriers give. That reduction may apply if the 16- and 17-year-olds attend college more than a hundred miles away from family and leave their automobile at residence.

Is Insurance Cheaper For College Students?

Yes, insurance can be cheaper for college students. College students should be able to demonstrate good grades at school and be excellent at participating in the good student discounts. Female college drivers may pay insurance around $322 monthly, and male college drivers may pay around $363 monthly.

What Type of Insurance Should You Have After High School?

Types of Insurance to have after high school:

- Personal liability insurance coverage

- Auto insurance coverage

- Renters Insurance coverage

- Health insurance coverage

Why Is Car Insurance So Expensive For Students?

Car insurance may be expensive for students if they lack experience. According to the Centers for Disease Control, students aged 16 to 19 pose more risk and are more likely to get into a fatal accident than students in their 20s. Driving takes time with practice and requires experience.

When Can I Take My Child Off Car Insurance?

Taking a child off car insurance is not necessary if a child is still in college or living with parents. Even if a child moves out, parents do not have to take the child from an auto insurance plan. A parent may continue to cover a child for as long as possible—no age limit.

How Can an 18-Year-Old Save Car Insurance?

An 18-year-old may save on car insurance:

- I was a good student and had good grades at school. A “B” average or higher can help save money on an insurance policy by providing rebate rates.

- Experience in driving may help save (knowing how to drive takes time, effort, and practice). But being experienced can also save a few bucks on car insurance.

- Purchasing a used car that’s known for safety can save on car insurance. When a five-year-old model is purchased, 18% may be held. The older the vehicle, the lower the rates will be.

What is the Average Good Student Discount?

The Average good student discount can be around 7%, according to carinsurance.com rate analysis. A good student discount is for young drivers who demonstrate good grades in school. A student may need a grade B average or higher to have a student discount.

How Effective are Student Discounts?

Student discounts have helped to save costs and made college life easy. Being a college student takes too many expenses, from meeting up with book payments and tuition to accommodation. But, having student discounts has helped students achieve the help they need with good rate discounts.

Is Car Insurance More Expensive For Students?

Yes, car insurance can be more expensive for students. It may cost higher for younger drivers and college students as well because young drivers are three times more likely to get into a crash due to their inexperience. Therefore, Auto-insurance companies may make it expensive for students.

Does Being a Student Lower Your Car Insurance?

Yes, a student can expect to get car insurance lowered. If a student appears to be good at school, has good grades with an average of B or higher, or is ranked in the top 20% in class, an insurance company may lower car insurance until the student is 25, as long as the student maintains good grades.

Is Progressive Insurance Good For Students?

Yes, Progressive Insurance is best for students with good grades. Students with good grades may qualify for the 7% discount on an auto insurance policy. Most states give 10% discounts to full-time students under age 23 with a B average or higher.

The deduction doesn’t quite apply whether they drive their car to school. An earlier, less expensive vehicle might help save on auto insurance when deciding on an automobile for a young driver. A burden vehicle healthcare insurance might be an excellent way to save on your premiums when you can buy a new car out of hand. Proper driving classes can also help your young driver save money overall. Aside from the immediate savings, completing a suitable driving course may help lower crash risk, protecting your family’s capital over the long term. Before enrolling your adolescent in the program, specify the insurance carrier to see whether they offer this reduction.

When deciding on an automobile for a young driver, consider an older, less expensive vehicle that might help cut down on auto insurance. If you can afford to fix your car out of cash, burdening auto insurance coverage might be an excellent opportunity to save some of your costs on your policy. The bank may demand comprehensive damage insurance if you purchase a new automobile with a mortgage. In comparison, a car that would cost thousands of dollars to rebuild in the event of an injury may require comprehensive insurance if you’re not dealing with such a creditor.

Picking a low-cost, early model allows you to employ burden protection to lower insurance premiums. Choosing the right car for your adolescent can save you hundreds or thousands of dollars annually. A roadster or a design and features may be exciting, but they will considerably raise a new motorist’s insurance prices. A secure, essential car is frequently the least expensive automobile insurance for a youngster. To illustrate, a Toyota Camry’s average yearly insurance price for such an 18-year-old is approximately $2900. Another Mustang GT, on the other hand, costs around $4000 per year to insure. By purchasing a Camry above a Mustang, you might save an equivalent of $1,304 yearly.

Insurance premiums for 18-year-old motorists are pricey since insurance firms base their rates on the driving experience. If you already have minimal driving dynamics, companies immediately assume you will make claims. Insurance also conducts an extensive study into demographic groupings, and centuries of data show that adolescent males are more careless while behind vehicles than other ages. Grading drivers based on these variables may appear precarious, but the number of fatal wrecks, hospitalizations, and other incidents still does not lie. Per the graph below, for each 25 million kilometers traveled, 16- and 17-year-old motorists were implicated in 3.75 fatal collisions.