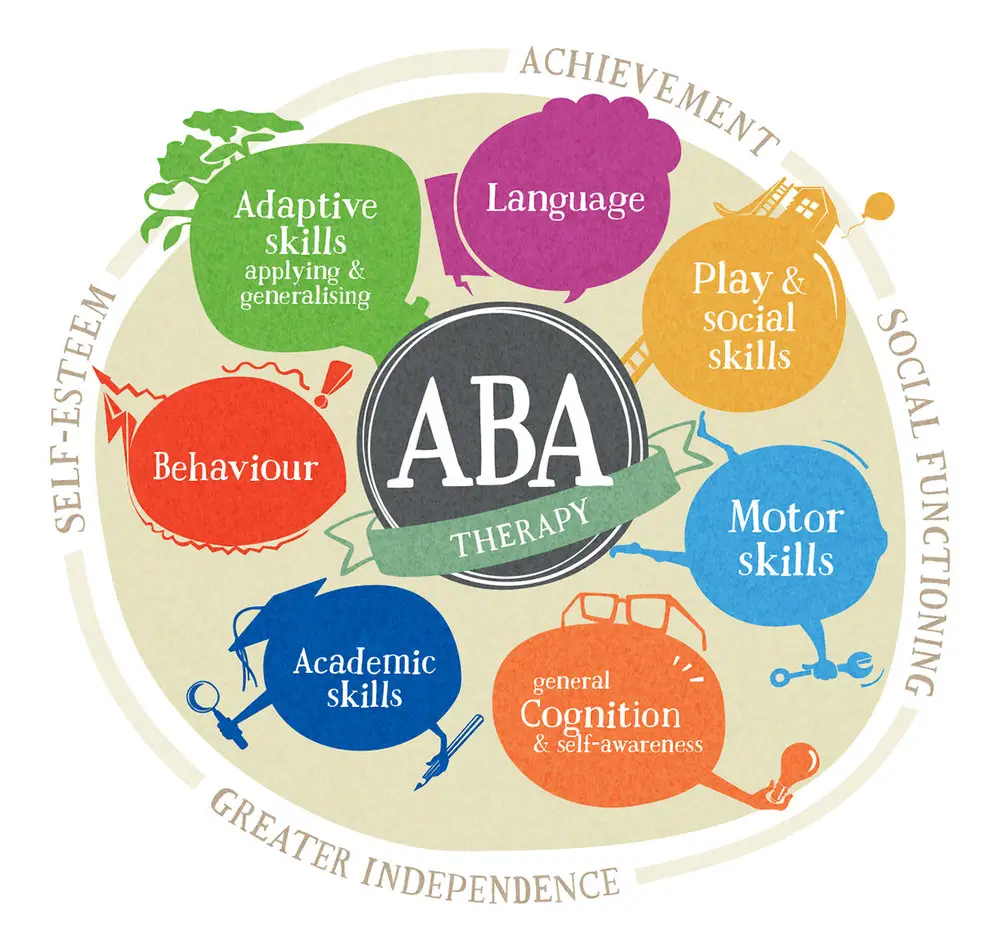

Applied Behavioral Analysis (ABA) therapy is a type of treatment that can help those living with Attention Deficit Hyperactivity Disorder (ADHD). It focuses on changing behavior through positive reinforcement and is highly effective in assisting individuals in managing their symptoms and leading more successful lives.

Does Insurance Cover ABA Therapy for ADHD?

Yes, insurance covers ABA therapy for ADHD in cases where autism is present or when it is medically necessary. However, in many cases, when ABA therapy is not medically needed, treatment will not be covered by insurance.

ABA (Applied Behavior Analysis) therapy is not typically used as a primary treatment for ADHD (Attention Deficit Hyperactivity Disorder). It primarily addresses behavioral and social deficits in individuals with autism spectrum disorder and other developmental disabilities. However, some individuals with ADHD may exhibit problematic behaviors that can be discussed through ABA therapy.

In cases where an individual with ADHD exhibits co-occurring behavioral issues, such as aggression, self-injury, or severe disruptive behavior, ABA therapy may be recommended as part of a comprehensive treatment plan. ABA therapy can help the individual learn new, more adaptive behaviors and reduce problematic behaviors through positive reinforcement and other behavior modification techniques.

It is important to note that ABA therapy should not be used as a substitute for the medical treatment of ADHD. Individuals with ADHD may require medication and other forms of therapy, such as cognitive-behavioral therapy or social skills training, to address their symptoms and improve their overall functioning. Therefore, the decision to use ABA therapy for ADHD should be made on a case-by-case basis in consultation with a qualified healthcare professional.

Many insurance plans cover ABA therapy if a qualified physician recommends it and the provider accepts your insurer’s reimbursement rate. Generally speaking, Medicaid and most employer-based programs offer some coverage for ABA therapy for ADHD. To find out if your plan will cover ABA services, you should contact your provider or insurer directly to discuss the specifics of your policy.

Even if your insurance does not cover all necessary treatments related to ABA therapy, there may be other options available to you. For example, some insurers provide mental health services at discounted rates, while others allow you to pay out-of-pocket if you submit receipts for reimbursement later on. Additionally, many states have programs that provide financial assistance for mental health care services such as ABA therapy; however, these programs vary from state to state and often have specific eligibility criteria that must be met.

Insurance companies’ coverage of ABA therapy for ADHD may vary depending on individual policies and state regulations. However, here is a list of some insurance companies that may cover ABA therapy for ADHD:

- Aetna

- Blue Cross Blue Shield

- Cigna

- Humana

- Kaiser Permanente

- Magellan Health

- Optum

- United Healthcare

It is important to note that even if an insurance company covers ABA therapy for ADHD, there may still be limitations and restrictions on the coverage, such as a maximum number of sessions or age limits. Therefore, it is recommended that you contact the insurance company to confirm coverage and any potential limitations.

In addition to checking with your insurer and exploring potential financial assistance options available in your state, there are other methods of obtaining funding for ABA services. For example, many nonprofits are specifically designed to help people with ADHD receive the therapies they need; these grants may require an application process to qualify for them. Other organizations provide scholarships that can also help defray the cost of treatment.

Ultimately, whether or not insurance covers ABA therapy for ADHD depends mainly on the specifics of each individual’s plan and situation. However, researching all available options — from checking with insurers and providers to exploring potential grants or scholarship opportunities — can be beneficial in helping one find a way to receive effective treatments without breaking the bank.