When it comes to insurance policies for flat roofs, there are a few different companies that you can turn to for coverage. The type of coverage that each offers will depend on the specific policy, so it’s important to carefully read through all the fine print before signing anything.

Do insurance companies cover flat roofs?

Yes, Insurance companies cover flat roofs for up to 20 years and usually offer special home insurance. However, flat roof insurance coverage is more expensive than regular home roof insurance because of more frequent water damage. After ten years, the insurance company needs to inspect the flat roof again.

Homeowners with flat roofs may face higher insurance premiums and additional coverage considerations. Regular maintenance, choosing suitable materials, and shopping for insurance can help homeowners find the best coverage.

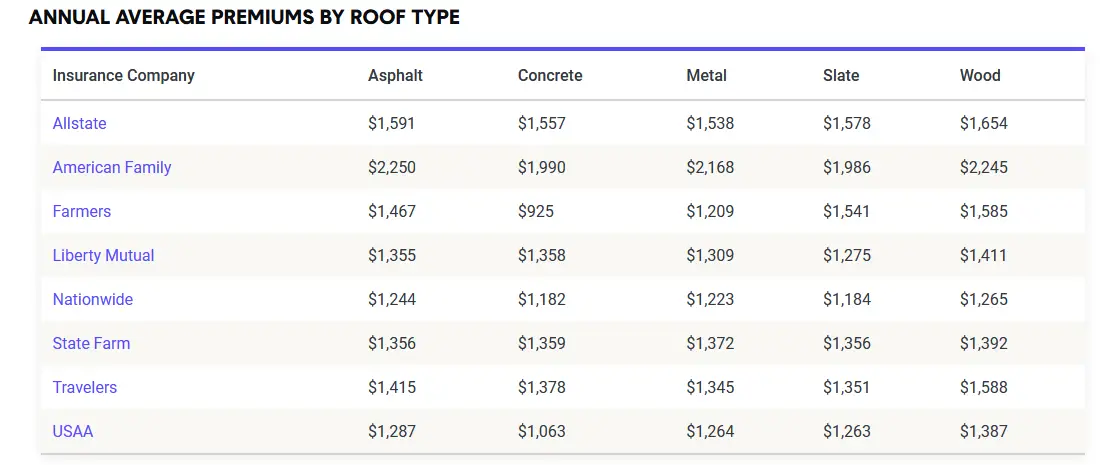

See annual average insurance premiums by roof type:

Which Insurance Companies Cover Flat Roofs?

- State Farm

- Allstate

- American Family

- Liberty Mutual

- Nationwide

- USAA

- Chubb Insurance

- Progressive Insurance

Here is a look at some of the top insurance companies that offer coverage for flat roofs:

State Farm is one of the most popular and well-known insurance companies in the US. They offer coverage specifically for flat roof damages and repairs, so homeowners with this type of roof should consider adding this option to their policy. State Farm covers replacement and repair costs if your roof is damaged due to bad weather or any other major cause. They also provide additional discounts in some cases if homeowners make certain upgrades, such as installing impact-resistant shingles or updating their HVAC system.

Allstate is another primary provider of insurance policies that covers flat roofs. Allstate provides coverage similar to State Farm, providing repair and replacement costs if your roof is damaged due to extreme weather or other causes. Additionally, they offer discounts for those installing wind-resistant shingles or cool roofs on their home.

Liberty Mutual also provides coverage for flat roofs under its home policies. Like its competitors, Liberty Mutual offers both repair and replacement benefits – although they also cover water damage due to leaking roofs as part of their policy options. Additionally, they offer further discounts if you choose metal roof installation instead of traditional asphalt-based ones because metal roofs are more durable and long-lasting than standard ones.

Progressive Insurance also provides coverage specifically designed for those with flat roofs. Progressive’s policy covers repairs and replacements should your roof be damaged due to weather-related forces or any other cause listed in their policy documents. They also offer discounts if you use impact-resistant shingles when replacing your existing roof, which can help reduce your premiums over time by protecting against storm damage much better than standard ones.

Finally, Chubb Insurance provides specialized flat roof insurance policies and general home insurance policies with some flat roof endorsements, depending on your needs and budget. Chubb provides comprehensive coverage against damage from storms, flooding, or other natural disasters, including covering any damages done by falling trees or debris during such events and offering discounts if you opt for wind-resistant shingles when repairing or replacing your existing ones.

Flat roofs have a unique set of considerations regarding home insurance. Here’s everything you need to know about flat roof home insurance:

- Insurance premiums can be higher: Flat roofs are generally considered higher risk than pitched roofs because they are more prone to leaks and water damage. As a result, homeowners with flat roofs may pay higher insurance premiums.

- Age of the roof matters: Insurance companies may require an inspection of the flat roof before offering coverage. If the top is older or in poor condition, the insurer may deny coverage or charge higher premiums.

- Maintenance is crucial: Regular flat roof maintenance is essential to prevent damage and avoid insurance claims. The homeowner should have the roof inspected regularly and any necessary repairs or replacements done promptly.

- Material matters: The material used for the flat roof can also affect insurance coverage. Certain materials, such as asphalt, may be considered at higher risk than others, such as metal.

- Coverage for water damage: Flat roofs are more prone to water damage, so it’s essential to ensure the insurance policy includes coverage for water damage. This coverage can include damage from leaks, flooding, and storms.

- Liability coverage: Liability coverage is essential for flat roofs because they can be a potential hazard for visitors to the property. If someone is injured on a flat roof, the homeowner may be liable for damages, and liability coverage can help protect against those costs.

- Shop around for insurance: Homeowners with flat roofs should shop for insurance coverage and compare quotes from multiple providers. This can help them find the best coverage and rates for their situation.

In conclusion, several insurers provide specialized flat roof insurance policies that can help protect your property from the damage caused by storms, flooding, or other outside forces that may come into play while owning a home with a flat rooftop design. Each company offers different levels of protection depending on what kind of climate you live in and what type of materials you use when constructing it. So, read through everything before making any final decisions!