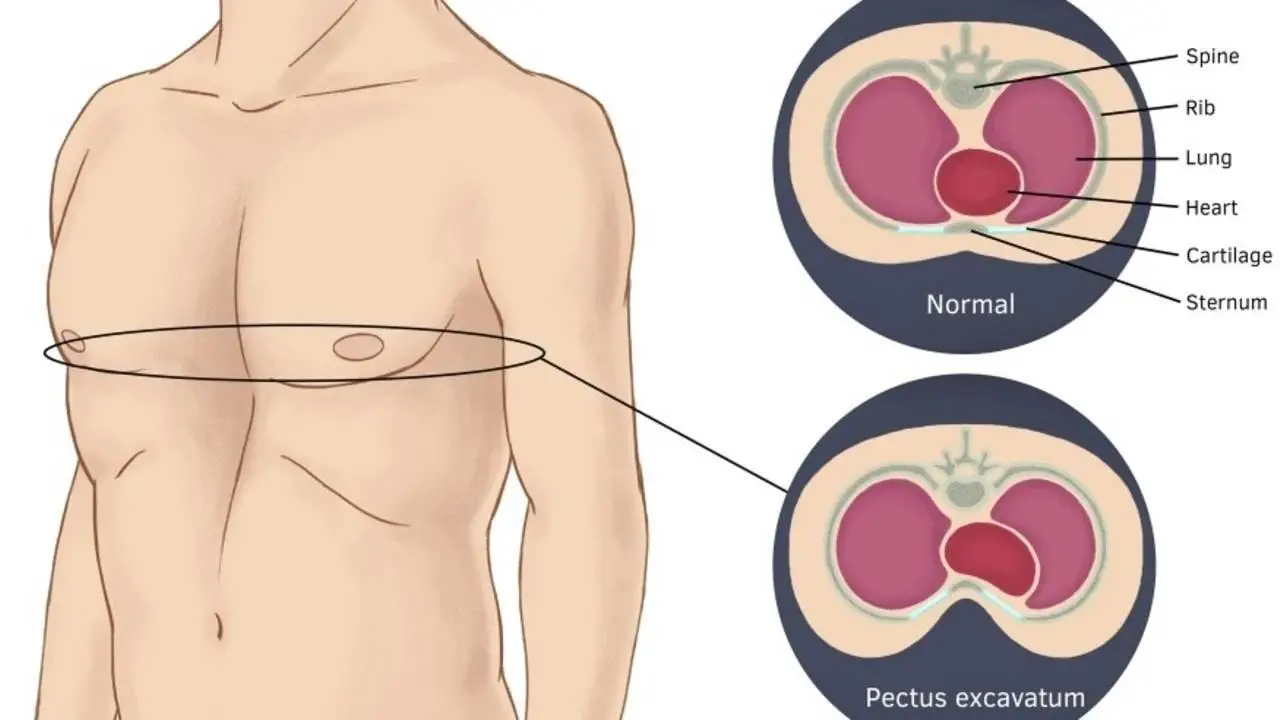

Whether insurance will cover pectus excavatum surgery largely depends on the type of insurance and the specific details of the policy. The Pectus excavatum is a condition where the sternum is pushed inward, resulting in a hollow chest wall. It is a cosmetic concern but can lead to cardiopulmonary issues such as restrictive lung capacity. Therefore, in some cases, surgery to correct the pectus excavatum may be necessary for medical and aesthetic reasons.

Does Insurance Cover Pectus Excavatum Surgery?

Insurance can cover pectus excavatum insurance surgery if a functional deficit arises from the sternal deformity. However, if the surgery is medically unnecessary (for cosmetic purposes), typical insurance usually will not cover that repair.

Pectus excavatum repair does not require prior authorization through the Health Services Division when specific criteria are met. These conditions include:

- CT Haller index ratio (pectus severity index) of 3.25 or greater,

- Pulmonary function studies demonstrate restrictive or obstructive lung disease

- Cardiac imaging (e.g., echocardiography, stress echocardiography, MRI) shows findings consistent with external cardiac compression

One of these symptoms is a reduced lung capacity, which pulmonary function studies may quantify. For example, suppose the Total Lung Capacity (TLC) is 80% or less of the predicted value. This indicates a significant limitation in the patient’s breathing ability, which may necessitate surgical intervention. In such cases, the Health Services Division recognizes the need for timely treatment and does not require prior authorization.

Additionally, suppose cardiac imaging findings, such as echocardiography, stress echocardiography, or MRI, are consistent with external cardiac compression. In that case, this also indicates that the Pectus excavatum is detrimental to the patient’s heart. If left untreated, external cardiac compression can lead to heart failure, arrhythmias, and other cardiovascular complications.

When a patient meets the criteria outlined above, it signifies that the Pectus excavatum is not only causing a cosmetic deformity but also has the potential to cause significant health consequences. In such cases, requiring prior authorization may result in unnecessary delays in receiving the needed surgical treatment. The Health Services Division acknowledges this and does not require prior approval for Pectus excavatum repair in these situations.

The Health Services Division supports patients’ access to timely medical interventions by not mandating prior authorization in these cases. This policy helps to avoid further medical complications due to delayed treatment and ensures that only patients who truly need the surgery receive it, thereby promoting the appropriate allocation of healthcare resources.

Several factors must be considered regarding insurance coverage for pectus excavatum surge. Generally speaking, if doctors establish the medical necessity of the surgery and appropriately document it early in medical records, most health insurance policies will cover at least part of the surgery. If there are no medical indications for the procedure or it is requested for cosmetic purposes, finding an insurer willing to cover any costs may prove difficult or impossible.

In most cases, insurers consider pectus excavatum surgery only when it has been proven that less invasive treatments, such as bracing or physical therapy, have been ineffective or not recommended by doctors due to a severe underlying medical issue. For instance, if it can be demonstrated that corrective chest wall surgery is necessary to improve lung capacity or prevent further damage from ongoing pressure on internal organs, chances are that most insurers will offer at least partial coverage for this kind of procedure.

It’s important to note that even when an insurer agrees to pay for all or part of pectus excavatum surgery costs, there may still be limits on how much they are willing to pay. The exact fee varies greatly depending on many factors, including thetype and the type of procedure required (such as open chest reconstruction versus minimally invasive surgeries) and which specific hospital and surgeon you choose to perform it. Most health insurers also require prior authorization before covering any treatment related to this condition, so communicate with them before scheduling any appointments with your doctor or surgeon.

Your best way is to talk directly with your health insurer regarding the treatments they cover and how much they’re willing to contribute towards those costs before proceeding with her with the surgical procedure related to this condition.