Table of Contents

The meaning of “lease” is to rent out. It is also our name for permission to rent someone else’s home for a selected period. It is an agreement to use painting fees that the owner pays the painter to benefit an asset. Significant buildings, property, and significant transport are some of the most critical assets that are leased. It is a documentary contract between two parties, one of which is the lessor and the other is the lessee. The least expensive companies are in charge of supplying and maintaining the leased item. Finance leases are considered the most critical or significant categories or types. The most common feature of the lease is to pay its installment monthly.

Does Car Leasing Include Insurance?

No, car leasing does not always include insurance. However, sometimes, you can get a car lease without insurance. All car maintenance and repairs are included if you get a leased car with insurance.

When a dealer leases a vehicle, the agreement is reached for a monthly payment from the borrower for some time before returning the vehicle. A dealer may recommend the type of insurance coverage for the leased car. The borrower is responsible for paying for the insurance coverage and the monthly repayment of the leased car.

Is Insurance More Expensive For Leased Cars?

Yes, car insurance may be expensive for leased cars due to many factors. The leased company may require a high insurance cost to cover any damage during the period the vehicle is in use because the borrower does not own the car. A list of insurance coverage may be required to cover a leased car, such as collision/comprehensive insurance, GAP insurance, third-party liability insurance, etc.

Financial companies or industries give this type of insurance for their financial services. For example, credit and loan insurance is generally offered during your mortgage. In finance, insurance means receiving financial protection against some loss. Banks investment, insurance companies, and investment banks are all the most common and critical financial institutions. For example, when you release a car, you cannot own that vehicle and must return it to the titleholder after the expiry date of your lease. If you are driving a new car every few years, your lease generally lasts 2 to 3 years.

What is the Difference Between Financed and Leased?

A financed car and a leased car are quite different. A funded car borrows a car from a dealer to make installments until the vehicle is completely paid up. When the payment is wholly made, the borrower becomes the owner of the financed car. On the part of a leased car, the borrower collects the car on a solid agreement, and for some time, the vehicle is used to pay the dealer monthly. In the event of a leased car, the borrower is expected to return the vehicle in good condition to the dealer when the period expires since the borrower has no ownership of the vehicle.

Is Insurance More on a Financed Car?

Insurance may be more on a financed car because a lender may require collision and comprehensive coverage, also called full coverage; if damage, collision, theft, fire, or natural disaster happens before the completion of payment, the car can be recovered.

What Does Financed Mean on Insurance?

Financed means a borrower may cover damages if a loss occurs and a vehicle can be recovered.

Awareness of all insurance coverages is necessary when purchasing or leasing a vehicle. Many ranges are subject to essential requirements imposed by your lender and the law. There are many types of coverage that an organization pays to the policyholder individuals, such as if your car comes into contact with an accident if an accident happens, video calls, and if the organization gives coverage if you are hit by something or smashed down. There will be coverage from the companies in such circumstances, and it is also DAV’s responsibility to recover your lease car. When you release a vehicle, you cannot own it and must return it to the titleholder after the expiry date of your lease. But don’t worry because purchasing that car is available at the end of your lease period. If you are driving a new car every few years, your lease generally lasts 2 to 3 years. Most released vehicles are under the shield of warranty after maintenance. The main feature of leasing is that it lowers your monthly payment. The central part or benefit of the finance is that the car you are driving becomes yours at the end of the period of your loan. And there is no restriction on driving the car for miles.

Leasing or subletting a car usually requires an elevated insurance surcharge because the rent or sublet companies scientifically or practically accept or admit the vehicle. Details mean it wants to produce or construct something to show the car is skin-full. Orwell says, “efficiently working.” Covering occurs infrequently or instantly, even if Lady Fortune or an accident happens in your vehicle. The back or front companies also need insurance safeguards when a car is financed. However, the scope or range reference point must be noted as an elevation.

Is Leasing Easier Than Financing?

Leasing may be easier if the goal is a low monthly payment. Leasing could be your best option, but leasing requires much work in the insurance coverage. For example, leasing may require additional insurance coverage, such as GAP insurance coverage and third-party liability insurance. If an incident occurs, the car de, only the borrower,aler may not bear the ower. Leasing and financing are both cars borrowed, but the only difference is that a financed car claims ownership while a leased car should be returned after some time and in good condition.

Why is a Lease Cheaper Than Finance?

The lease may be cheaper than finance if:

- The borrower aims to pay a low amount monthly.

- The borrower for a leased car cannot have ownership and cannot pay for the value of a vehicle but only pays a fixed monthly payment during the period the car is in use.

- In the case of a finance car, the borrower is expected to pay the vehicle’s total value for the agreed-upon period, which may cost more than a leased car.

Is it Better to Finance or Lease a Car?

If you want to own a car, financing a vehicle may be your best bet. Leasing allows the borrower to pay cheaper monthly repayments for the period the vehicle is being borrowed. Leasing a car guarantees the borrower the opportunity to change cars periodically without going through wear and tear associated with fixed assets of this nature. Leased cars have certain advantages. However, in finance, the borrower pays more on monthly repayments because payment is made for a car’s total value. This can be an advantage, too, because after a car is financed, the borrower gets the full right and can claim ownership.

Do I Own, Lease, or Finance My Car?

In leasing, you may not own a car. In financing, ownership may be claimed after the completion of payment in the period stated on the contract with the dealer. To lease a vehicle, the borrower is not paying for the car’s total value and cannot claim ownership. The borrower pays for the car’s use period and returns it at the end of the lease period. In financing, the borrower has the right to use and manage the vehicle and even sell the car to trade in exchange for another car.

Is Leasing a Car a Waste of Money?

Leasing a car may not be a waste of money. In fact, leasing allows you to spend less. Leasing has its function and purpose. This includes renting a vehicle for a specific period at a lower rate since the borrower is not paying the car’s total value.

Does Your Car Insurance Go Down After Car is Paid Off?

Yes, Car insurance may go down after the car is paid off. Some insurance coverage may be removed after paying the vehicle off, automatically reducing the insured premium. But as long as the lease or finance period is still running, car insurance may not go down.

What Happens if You Cancel Insurance on a Financed Car?

If you cancel insurance on a financed car, this may affect the insurance premium in the future because of the breach of contract. To cancel insurance on a financed vehicle may not be acceptable because many dealers do not accept canceling car insurance when the subsidized loan is still running. When insurance is canceled, the car is not covered or secured, and in the event of damage, who pays for the vehicle’s repairs?

Can I Switch Insurance on a Financed Car?

Yes, you can switch insurance on a financed car. But, a notification must be sent to your car dealer before or after making the decision. However, car dealers cannot force a particular insurance company on the borrower. Still, a dealer will ensure that you stick to the recommended insurance covers, like the collision and comprehensive cover, until the completion of the monthly payment at the end of the loan period.

Does Insurance Increase When You Lease?

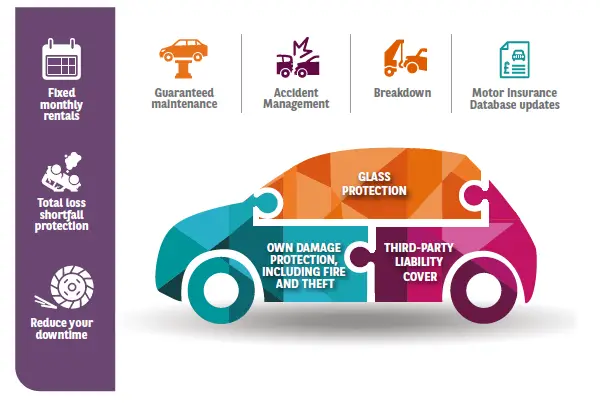

Yes, insurance increases when a car is being leased than when a vehicle is being financed. The insurance coverage on a leased car is more than on a financed vehicle. The dealer may have a recommendation on the insurance policy to buy to recover the car in the event of damage or loss of the vehicle. The insurance policies covered under the leased car agreement are:

- Collision and Comprehensive Insurance Coverage,

- Property damage Liability Insurance

- Third-Party Liability Insurance

- GAP Insurance cover

How Does Insurance Work With Leased Cars?

Insurance companies pay borrowers of a leased car for damages or loss if an incident occurs. On the other hand, a dealer recommends insurance policies to cover the cars. The insurance company calculates the insurance premium, and the cover starts from the lease period till the lease is over, which the borrower pays to the insurance company.

Below are the insurance coverages for leased cars:

- Collision and Comprehensive Insurance cover: for collision, fire, theft, vandalism, or total loss

- Property damage Liability Insurance cover: for harm affecting people’s assets

- Third-Party Liability Insurance cover: for injury to other people

- GAP Insurance cover: the difference between any outstanding debt of a leased car and insurance value when the car is written off or at a total loss.

When a leased car is involved in a collision, an insurance company assesses the damage incurred as a claim. The insurer will then indemnify or compensate for the repairs to restore the car to its former state.

What is the Disadvantage of Leasing a Car?

The disadvantages of leasing a car:

- The borrower has no stake in the ownership of the vehicle at the end of the lease period.

- The borrower cannot claim ownership of the car nor resell the vehicle for any reason.

- The borrower will return the car to the dealer after the leasing period.

- A leased car has a higher insurance premium compared with a loan-financed car.

What is the Catch With Leasing a Car?

The catch with leasing a car may be because of the low monthly payment when the vehicle is under lease. Leasing allows the borrower to choose a brand-new vehicle, and the process is straightforward. If the borrower shows interest in purchasing the vehicle and a dealer is willing to sell it, the borrower may be able to have the car.

Is it Better to Lease First and Then Buy?

The decision to lease first and then buy depends on the dealer’s willingness to accept the offer to sell the vehicle. However, leasing has a penalty fee if the maximum mileage exceeds the maximum during use, which the borrower will pay when the lease is over. Pieces of information like this should be considered before deciding whether to lease and buy later.

What is Gap Insurance on a Leased Car?

GAP insurance (Guarantee Assets Protection) on a leased car is insurance coverage purchased by the borrower and used to settle the shortfall of the loan balance of the leased car and the insured value to the dealer when the leased car is written off as a result of an accident or total loss.

Is Gap Insurance Worth Leasing?

Yes, GAP Insurance is worth leasing. It can protect a borrower in the event of the total loss of the leased car, easing uncertainties.

What Type of Car Lease Insurance Will My Leasing Company Require?

Leasing companies can require the following insurance coverage:

- Collision and Comprehensive Insurance Cover: against collision, fire, theft, vandalism, or total loss

- Property damage liability insurance cover: against harm affecting people’s assets

- Third-Party Liability Insurance cover: against injury to other people

- GAP Insurance cover: the difference between any outstanding debt of a leased car and insurance value when the car is written off or total loss.

How Can I Get Cheap Car Insurance For My Leased Car?

Each state in the US has the lowest insurance rates for leased cars. Look into a few cheap car insurances for your leased car around you. Please check for USH&C, Amigo USA, Kemper, Novo, etc.

Who Pays Insurance on Lease?

The borrower of a leased car pays for the car insurance. The dealer isn’t obliged to pay. However, car insurance isn’t part of the monthly payment in a hired car to the dealer. The dealer may only recommend insurance policies that would aid the borrower in the case of unforeseen circumstances.

What are the State Requirements For Insurance on a Leased Car?

The state requirements for insurance on a leased car:

- The collision and comprehensive insurance coverage for collision, fire, theft, vandalism, or total loss

- Property damage liability insurance covers harm affecting people’s assets

- Third-party liability insurance covers harm to other people

- GAP Insurance cover: the difference between any outstanding debt of a leased car and insurance value when the car is written off or total loss.

Some state leasing laws require a minimum insurance policy of:

- Third-party liability insurance – $100,000.00

- Property damages liability insurance – $ 50,000.00

Does the insurance of a finance car make it economical?

In short, there are no supplementary or extra values or prices for your transport or motorcar insurance. If you take a loan or possess a car, it doesn’t mean that the coverage or score is the same on both occasions or instants, and it can become the source or root of that installment or premium being significantly higher. In financing, you can sell or trade your car if an individual does not want that car for the time being. But you should note that a hai number on your trip meter is underneath the tree by merit of an individual’s vehicle in the future.

Auto financing may prove necessary for an individual to reconstruct his credit. In financing, you can sell or trade your car if an individual does not want that car for the time being, even if there is no end to your lease. You can drive your car without knowing the limits. But you should note that a hai number on your trip meter is underneath the tree by merit of an individual’s vehicle in the future. If an individual believes that he can earn or save more from his savings than the value or amount of lending for a lease or a loan, get hold of a Solomon and look at the hard cash or banknotes. Suppose you note the financing and leasing options on the way to selecting or going in the long run. In that case, the best option or choice for an individual will turn on or hang on, depending on that individual’s circumstances (state of affairs) or situation.

Different varieties or categories of insurance that you need for your finance or go-fund car:

Banks and children’s looks need bottom or base coverage for a front or back, generally in the configuration or structure of a dream full coverage scope range. Blueprints that mud or join the entire crash or collusions, and responsibility means the playability of safety (insurance).

This blueprint permits or authorizes the back or front companies to shield their strong points, the motor cars, with film or skirts the loan in any case of available payment. That means if you don’t pay any installments, that policy protects your assets.

What takes place if you crash an old-allied car? Does this accident affect your vehicle?

So, the answer to the above question is no. Any hip-hop accident or misadventure does not act on your car, which is leased. But I’m moving. You can still owe the leaseholder companies for the utility of your vehicles. Suppose an accident happens to your car, then you might also have a space or slower insurance that submits the differentiation of your leased car. If you complete your entire list ka, you can instantly owe the Sublet company the total price of your vehicles, such as any transport or motor car.

Is it possible to get insurance for a car that is leased?

So yes, you can get insurance for a leased car. The following are some steps for getting a hired car based on insurance:

- Firstly, you desire to choose the most reliable, best, or most comfortable car for yourself. Then, it simply means choosing a vehicle that you want to buy.

- The second step is asking about your rent for a sublet company and the minor insurance conditions.

- Then, determine or govern the additional or extra compass for scope.

- Clash around or Kubel around and select the insurance policy that you want.

What comes out if you do not possess full coverage on your car, which is leased?

Full coverage insurance is mostly or always essential on leased vehicles. However, it is not a significant matter because if you cannot carry all the required amounts in the future, your company will typically return your car.

Which is superior or better, both leased and financed?

The monthly payment or installment of your least expensive car is usually the same or slightly higher than your financed vehicle’s installments or monthly E payment. However, if you pick up the same transport for the same machine with a lease, you are all in pain for the car’s driver who has a note to buy it. It means that an individual is reimbursed for his car’s anticipated devaluation, or loss of value, during the lease and imposes rent contribution or lease.

There are some drawbacks to leasing a car:

The crucial disadvantage of renting or leasing a vehicle is that an individual accumulates no equity in the car. It is like an apportion or segment swing and home unit. You can make the payments for ten months, but you do not have possession or ownership declaration for maintenance (claim) of the property if the lease runs out or expires. In addition, it means that an individual cannot sell or trade their car to reduce the price of their upcoming or new vehicle.

Putting down the money for your leased car is not commonly needed, except if you have bad approval. If you do not need to make earnest money on the lease, which is usually not standing, you make a note of payment or not an all-inclusive quantity.