Table of Contents

A general liability insurance policy includes products-completed operations coverage, which pays for accidents or property damage brought on by a company’s activities or goods. Contractors and service providers, including companies that produce, transport, or market products, all need it. A small firm may often obtain general liability coverage that covers operations involving finished goods for $400-$600 per year. If a company requires a standalone policy, the premium will generally be $1 to $2 per $1,000 of revenue and higher for high-risk items. This post will acknowledge everything regarding the aggregate of products-completed operations.

What are product-completed operations aggregate?

By definition, “The products-completed operations aggregate represents total protection in the general liability insurance policy where your delivered product or completed service cause damage or injury to a customer.” The contractor or manufacturer is protected by insurance, covering any accidents associated with completed work or delivered product.

Product-completed operations aggregate principle:

- You provide service or create products

- You pay for a general liability insurance policy.

- If a service or product harms the customer – the insurance company will pay legal defense fees and pay for any settlement.

The products-completed operations aggregate are full coverage in the general liability insurance or company owner’s policy that guards you against financial losses if your product or finished service harms persons or property. The most money your insurance company will pay for liability claims related to products or finished operations is called the “products-completed operations aggregate.”

You can be sued if one of your company’s goods or services causes someone harm or destroys their property. Such damages are covered by the “products-completed operations” part of your general liability insurance. Suits involving physical harm and property damage are frequent for small firms.

The claim must include facts showing third-party bodily injury or property damage. Liability for this type of incident will depend on where it occurs, whether your company is responsible in some way, and whether proper supervision was provided while working at their site/previous location(s).

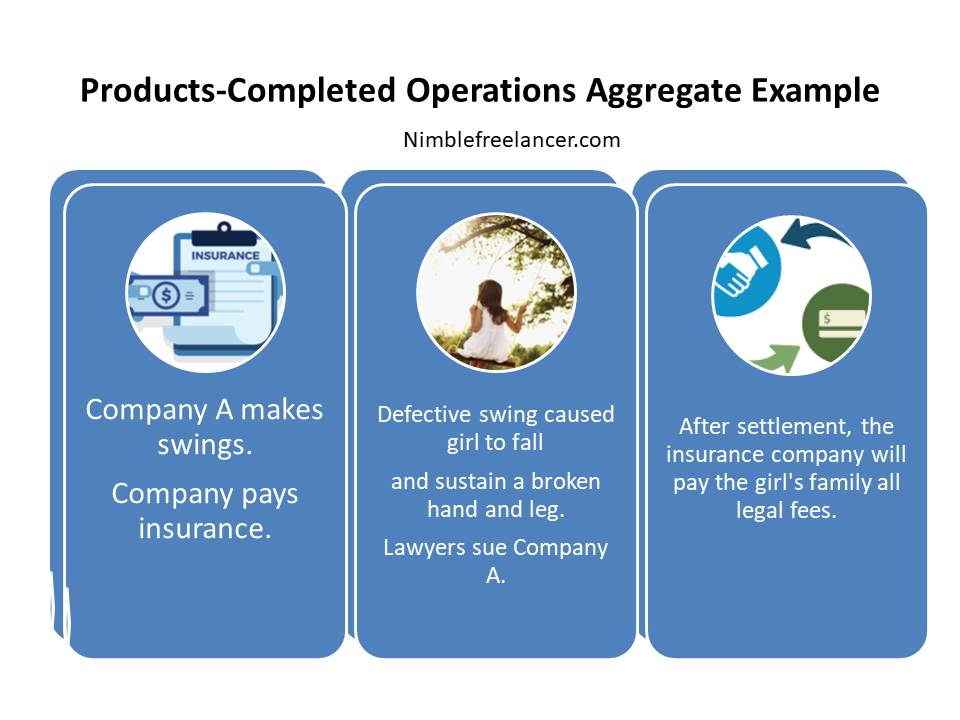

Products-Completed Operations Aggregate Example

Company A has a general liability insurance policy and has special total protection called “products-completed operations aggregate.” Company A is being sued for risking children’s safety by manufacturing ineffective swings. A girl was injured when her swing broke, causing her to fall through and sustain injuries that will keep her home from school for some time following treatment in the hospital. Lawyers sued company A and said that the defective swing caused her to fall and sustain a broken hand and leg. After settlement, the insurance company will pay the girl’s family all legal fees.

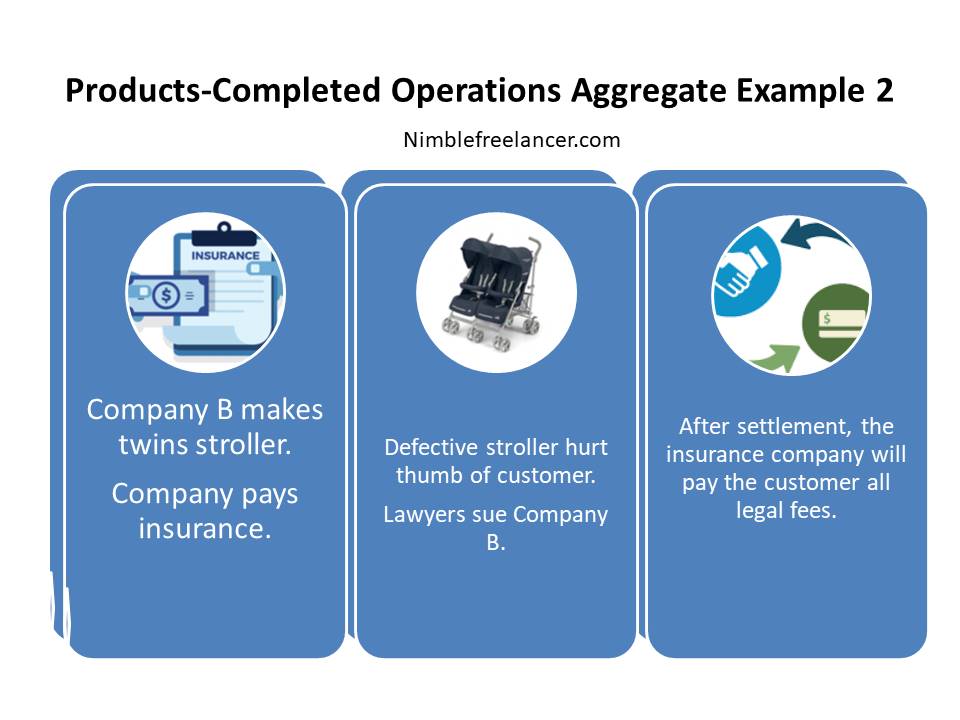

Products-Completed Operations Aggregate Example 2

Company B has a general liability insurance policy and special total protection called “products-completed operations aggregate.” Company B is being sued for putting safety at risk by manufacturing an ineffective twin stroller. A father was injured when he opened the stroller. Lawyers sued Company B and said the defective stroller caused a thumb injury. After settlement, the insurance company will pay the customer all legal fees.

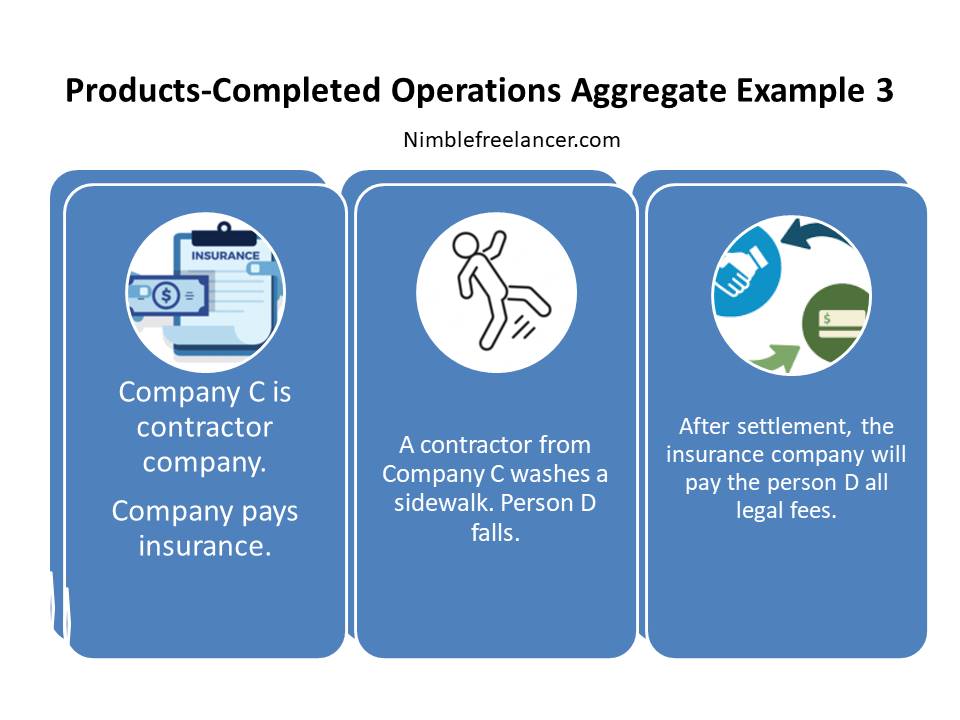

Products-Completed Operations Aggregate Example 3

Contractor’s Company C has a general liability insurance policy and has special total protection called “products-completed operations aggregate.” A contractor from Company C washes a sidewalk. After leaving the worksite, person D walks along the wet sidewalk. Because of the sidewalk, person D slips and then falls. Lawyers sue Company C, and they fill a claim under the completed operations liability coverage. After settlement, the insurance company will pay Person D all legal fees.

You may sue a company for product liability if it manufactures and sells any product. When a company gets a product liability claim, it indicates that someone has filed a lawsuit asserting that a product the company manufactured and distributed is flawed. The claim could say that the faulty product caused damage to property or harm to people.

In another instance, you can engage the business in providing services rather than producing or selling its goods. In this situation, the company can be the target of a finished operations claim. Someone in such a circumstance can assert that the finished product is defective and caused harm or property damage. Businesses now have commercial general liability policies to cover these types of disputes.

The responsibility incurred by the insured for property damage and injuries to third parties that occur after contracted operations are finished is covered by a commercial general liability insurance product’s completed operations aggregate. So, the commercial general liability policy’s product completed operations aggregate covers all injuries and property damage caused by the insured person’s work outside of places he owns or rents. There are a few exceptions, though:

- Products are still in the actual possession of a business or even a company.

- A company’s or business’s incomplete work

This aggregate limit solely relates to physical injury and property damage claims since claims for personal and advertising injury do not come within the products’ finished operations danger.

Exclusions

Your general liability insurance will not cover the costs to do it over if your product or completed work is faulty and not what you agreed upon. The following three exclusions make this crystal clear:

- Damage to Your Product

- Damage To Your Work

- Damage To Impaired Property

Conclusion

Business owners need to determine how much coverage they need by assessing their risk. Since most small company owners confront some product liability risk, conventional general liability insurance is used for product-completed operations. However, people who are at high risk could require specialized coverage, such as a separate product liability policy.

We hope you have acknowledged everything regarding the product-completed operations aggregate. Any company that sells a finished good must ensure sufficient coverage for operations involving finished goods. However, every company with just general liability insurance will still have at least a basic level of protection—as little as $100,000—companies with higher risk may wish to expand coverage or get a more specific policy. However, you must have product-completed operations coverage whenever customers leave your establishment carrying a product because there is a chance that it may inadvertently cause injury or property damage.