Table of Contents

The Department of Transportation in most states utilizes a point tracking system for individuals who acquire risky driving behaviors on the road. Every state has laws, but infractions such as driving, going through a red light, and causing a severe accident can result in consequences. If you start building up points on your driver’s license, you may be charged extra for vehicle insurance – and your license may be suspended.

You have the constitutional right to drive since you have a driver’s license. In exchange, you must follow all applicable driving rules. Several states maintain personal driving history by assigning points to your license if you get a mobility violation citation. In addition, health insurers utilize their proprietary systems to track customer violations. These scoring systems are aimed to promote safe driving but discourage dangerous driving. Amassing too many points may result in your license being canceled or revoked and a spike in your insurance costs. And here is all you need to understand concerning driver’s license points.

What are the Points on Your License?

Points are issued when a person is convicted of a traffic violation. The points are documented in a driver’s record. The severity of a breach determines the number of points that are issued.

Even if you’re playing or collecting frequent flyers, accumulating points is typically positive. On the other hand, you should avoid points on your driver’s license. So, how do you gain points on your license if they aren’t the points you aim for?

Driving points threshold in the USA

| US State | Point threshold | Time period |

|---|---|---|

| Alabama | 12 | 24 months |

| Alaska | 12 | 12 months |

| Arizona | 8 | 12 months |

| Arkansas | 14 | 36 months |

| California | 4 | 12 months |

| Colorado | 12 | 12 months |

| Connecticut | 10 | 24 months |

| Delaware | 12 | 24 months |

| Florida | 12 | 12 months |

| Georgia | 15 | 24 months |

| Hawaii | N/A | |

| Idaho | 12 | 12 months |

| Illinois | 15 | 12 months |

| Indiana | 20 | 24 months |

| Iowa | 6 | 24 months |

| Kansas | N/A | |

| Kentucky | 12 | 24 months |

| Louisiana | N/A | |

| Maine | 12 | 12 months |

| Maryland | 8 | 24 months |

| Massachusetts | 12 violations | 5 years |

| Michigan | 12 | 24 months |

| Minnesota | N/A | |

| Mississippi | N/A | |

| Missouri | 8 | 18 months |

| Montana | 15 | 36 months |

| Nebraska | 12 | 24 months |

| Nevada | 12 | 12 months |

| New Hampshire | 12 | 12 months |

| New Jersey | 12 | 36 months |

| New Mexico | 7 | 12 months |

| New York | 11 | 18 months |

| North Carolina | 12 | 36 months |

| North Dakota | 12 | Any |

| Ohio | 12 | 24 months |

| Oklahoma | 10 | 5 years |

| Oregon | N/A | |

| Pennsylvania | 6 | graduated time frame |

| Rhode Island | N/A | |

| South Carolina | 12 | 12 months |

| South Dakota | 15 | 12 months |

| Tennessee | 12 | 12 months |

| Texas | 8 | 12 months |

| Utah | 200 | 36 months |

| Vermont | 10 | 24 months |

| Virginia | 18 | 12 months |

| Washington | N/A | |

| Washington DC | 10 | Any |

| West Virginia | 12 | 12 months |

| Wisconsin | 12 | 12 months |

| Wyoming | N/A |

What Do Points on Licence Mean?

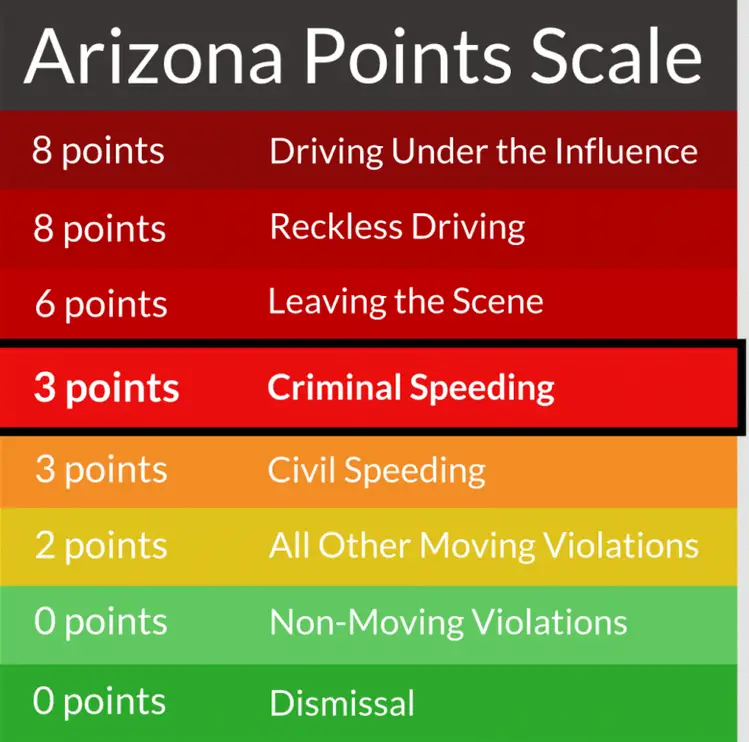

Points on the license mean a moving violation has been committed. The moving violation may be over-speeding, driving without insurance, etc. Points are consequences to a driver’s license/record. Usually, you can incur from 2 to 12 points. If you drive too closely, you can incur 2 points, while if you operate a vehicle under the influence of narcotics, you will incur 12 points.

Do Speeding Points Affect Insurance?

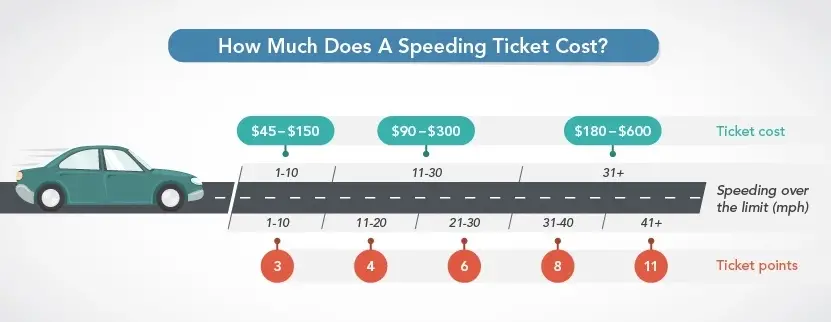

Yes, speeding points can affect insurance premiums. Usually, insurance companies will increase your coverage by 10% up to 40% if you have speeding tickets and incur driving points. A speeding ticket can be between four and six points depending on the speed level and the US state.

An insurer may need to check the driver’s driving record or status to obtain complete information about the driver’s history. If a driver incurred too many speeding points in the last five years, it might affect an auto-insurance premium as the insurer may view the driver as a high risk.

State automobile agencies and insurance firms use point schemes to measure driving efficiency. However, they are independent evaluations. Until you are guilty of certain driving offenses, DMV credits are assessed. If you amass too many marks quickly, your license will usually be canceled. Insurers usually ignore DMV points since they use their point process to track how much to boost your premium. Your rates increase by a predefined approximate amount on the transgression during certain levels.

Driver’s license point schemes help states and health insurers identify high-risk users. Tickets can be applied to your driver’s license at the government level if you are ticketed for only specific categories of moving offenses. The amount of pixels you receive depends on the quality of the infraction. In NYC, for instance, exceeding the stated speed limit by 1 to 10 mph can result in multiple penalties. Driving recklessly, using a smartphone while driving, or failing to avoid school are all five-point offenses.

Your nation’s Department of Transportation (DMV) webpage may illustrate its scoring system. Unfortunately, the points-based system on your driver’s license does not track the infractions you’ve incurred. In other words, it is not as easy as receiving one point for each infringement. However, the amount of points is adjusted depending on the seriousness of carelessness. Throughout Alaska, for instance, a traffic violation is from 2 to 6 penalties, whereas a DUI is worth ten spots.

Some offenses will not result in penalties for your driver’s license. Parking tickets, for example, might not even count against your scoring average, depending on where you reside. On the other hand, minor infractions can still result in a penalty. You must pay for the ticket when no points are assessed to your driver’s license. Moreover, receiving a ticket may increase your vehicle insurance premiums.

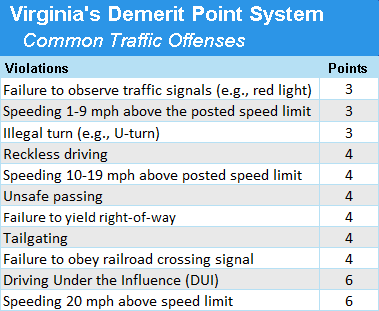

The number of penalties on your driver’s license is determined by the type of infraction and your state of residency. The same offense might be awarded a distinct amount of points in a nearby form. Exceeding the speed limit in Arizona, for illustration, will earn you three points on your license, but hurrying in Nevada may cost you 1 to 5 marks, according to where you were traveling. In speaking, Semi infractions and minor offenses will not result in a point judgment.

This implies that parking fines and fix-it violations for issues like cracked windshields will not earn you marks, even if you must pay the money. However, significant infractions, such as DUI, result in an immediately suspended license; therefore, no points are issued, but your vehicle insurance premiums will undoubtedly rise. For example, according to Insurance.com research, a DUI arrest results in a 19% rise in premium costs.

It would be best to charge you with a transportation infraction before points are applied to your license. However, if you accumulate an incredible number of charges briefly, the state’s DMV may suspend or terminate your license. The number of points needed to obtain a suspension differs from state to state, and the time frame varies. For instance, your aggregate point total in York City is calculated based on available two years of driving behavior.

If you accumulate 11 points, your license may be terminated. Georgia examines a driver’s background for the previous 24 hours and needs 15 points for a penalty at the other extreme. Your license can be terminated throughout North Carolina if you get 12 points in three years. The duration of punishment might also vary depending on the jurisdiction and if it is your first or second punishment. Likewise, issues can remain on your records for up to ten years based on your licensed jurisdiction. Assuming your state’s DMV keeps digital vehicle information and renders it public, you may count the status of points you’ve accrued against your license online.

Although forty-one jurisdictions prohibit texting and driving, just under half consider texting a driving infraction. Suppose you are fined in a state wherein messaging crimes add penalties to your driver’s license or are deemed traffic offenses. In that case, your insurance company may boost your premiums after reviewing your driving history.

There seem to be nine jurisdictions that do not utilize points to track dangerous drivers. However, that doesn’t guarantee you’re excused if you accumulate penalties. Other states merely examine your driver’s license to evaluate if your license should indeed be suspended or revoked. In Oregon, for example, whether you have four crashes or four guilty pleas, a blend of the following 24-month timeframe, then lose your license for 30 days. Furthermore, because vehicle insurers check your driver’s license, infractions might impact your premiums.

Besides serious offenses such as DUI, numerous states help complete a valid driver’s license to eliminate a crime before it appears in your history. The rules differ by state, so consult your healthcare regulator for specifics. For example, vehicles in Virginia can receive “proper driving points” in addition to speeding fines. You will receive traffic safety marks for each full financial year in which you have a current Virginia driver’s license and drive without any infractions or prohibitions. In addition, you can earn several additional proper driving points, which you can then use to negate penalty points.

Drivers’ record penalties can follow you from two to three months in many jurisdictions for minor violations, although there are alternatives. For example, in Virginia and Michigan, points are assessed for two months from the punishment date. Points for lesser offenses stay on your records for three months in California, whereas DUI and hit-and-run charges remain on your reputation for ten years. In Nevada, points are only recorded on your history for a year, although serious offenses, such as DUI, result in instant license revocation rather than consequences. You usually get driver’s license points when you get a penalty for going through a red light. However, if the willed-light computer captures you in specific categories, you will not receive any issues. Other jurisdictions penalize you for going through red lights if a video or a constable catches you. For instance, red-light penalties issued through a computer or security agency are worth 2 points in Phoenix.

On the other hand, New Jersey adds 2 points only if you receive a standard ticket from a law enforcement officer. Moreover, even though the DMV keeps your official driver’s license, automobile insurance providers do not rely on state rating systems. Instead, insurers use different methods to calculate your premium and rate hikes based on their operating history and other criteria. This also implies that insurance costs do not have to rise if you inadvertently violate traffic rules and receive driver’s license points. Progressive provides an optional catastrophe forgiveness policy, which keeps your rate from altering following a car accident, particularly unless you’re responsible.

Your lending insurer assessment, which forecasts how inclined you are to submit a claim, may be used by insurers to assist in determining your rate. Yet, under certain jurisdictions, this technique is prohibited or severely controlled. Conversely, your state may recommend the specific credits and fees that vehicle insurance providers apply to your coverage.

For illustration, Massachusetts’ Safe Driving Insurance Policy is a merit-based grading system that companies can use to guarantee that individuals with charges on their histories pay more for insurance coverage than those without infractions. Rodrigo’s “Driving License” music was indeed a smash hit; however, it didn’t include the marks Rodrigo may accumulate for reckless driving. You can’t avoid your driving history; besides, the DMV and your insurance are watching how you drive. Amassing too many credits might result in an increase in your vehicle insurance cost and potentially the cancellation or loss of your license. Nevertheless, points do not follow you eternally, so you are never old enough to adopt improved driving judgments.

Insurance carriers are not required to use the same scoring system as your government’s vehicular agency. Instead, carriers may utilize private point systems to allocate points for certain driving infractions. Facts given by an insurance provider will not result in losing your license. However, if you acquire excessive amounts, they might increase monthly insurance prices or cancel your coverage.

Certain insurance carriers and contracts may be more liberal than others.

Several states allow you to minimize the penalties that might lead to revocation of your driving skills. The marks you’ve earned will not be removed from your account, but your overall points will be lowered for disqualification calculations. Generally, reducing issues entails passing a safety briefing. For example, taking a defensive operating vehicle avoidance course in New York might deduct three to four points from your license.

After five years, Georgia eliminates up to seven points for completing a recognized driver enhancement course.

A DUI and DWI conviction generally indicate that you must be determined to be driving while intoxicated with alcohol and other chemicals in contradiction to your state rules. Additional chemicals include illicit narcotics, prescription meds, or over pharmaceuticals. Some jurisdictions may also classify domestic compounds used as bronchodilators, including lighter fluid or glue. Whenever a vehicle is accused of a DUI or DWI crime, the punishment imposed by each state varies. On average, the more and more DUI and DWI charges you have, the harsher the penalty.

Do speeding tickets without points affect insurance?

No, usually, speeding tickets without points do not affect insurance. In personal experience, if you successfully remove points, the insurance company will not have information about your traffic violation, and your insurance will not increase.

How to Get Points Off Your License?

To get points off your driver’s license:

- Conclude and finish a defensive driving course online from a state-certified school.

- Study at a convenient time.

- Discard a ticket.

- Take points off the record.

How Long Do Points Stay On Your Driving Record?

Points can stay on your driving record for two years from the date of conviction. However, each state’s period for keeping points on an individual driving record may differ.

How Many Points to Suspend License?

To have a suspended license, a person may have incurred an average of 6 points or more in the driver’s record. The offense varies, and points may differ. Every state in the US has different points issued for other types of violations before a license gets suspended.

How Many Points On Your License Before You Lose It?

To lose your license, you may have accumulated about 12 points or less, depending on the type of violation. If within a year or two after passing a driving test, a person incurs about 12 points, the driver’s license may be lost or revoked.

Does 3 points for speeding affect insurance?

The three penalty points for speeding insurance can increase your policy cost. Depending on the insurer, 3 points on your driver’s license may not impact your auto insurance policy much. However, three points can increase a driver’s insurance by 23% in some cases.

Do You Have to Tell Insurance About Points Straight Away?

Yes, it is vital to tell insurance about points straight away. If you don’t, the insurance company will know anyway. Usually, the MVD (Motor Vehicle Department) sends a message to insurance companies about points. A driver needs to tell the insurer of any points. Reputable Insurance companies take it as an offense to withhold points. It is advisable to be up-front and send a message when points have been incurred.

How Long Do Driving Points Last?

Driving points can last on a license for four years. In the event of more severe cases, points may stay on a driver’s license for eleven years if an incident caused death by DUI.

Do Insurance Companies Check Points?

Insurance companies may check points. When trying to get insurance, insurers may check points and determine if a person is high-risk. The number of points may affect the insurance premiums primarily if a driver incurred too many points and if a high-risk driver.

Do I Have to Declare Points After 4 Years?

Yes, points marked against your driver’s license should be declared to the insurance company by informing the insurer about the points within five years. Legally, a driver must notify the auto-insurance company when points are incurred on a driver’s license before getting a new quote. However, some points from driving, like drug-related offenses or car accidents causing death, may stay on the permit for 11 years.

What Happens if You Get 6 Points in the First 2 Years of Driving?

If in the first two years of passing a driving test, a driver accumulates 6 points penalty. The driver’s license can be revoked, and the driver issued a fine.

How Many Points Do You Get For No Insurance?

Points for no insurance can be around 6 or 8. Heavy fines may be involved, as well as a possible disqualification from driving.

What Happens if You Get 6 Points on Your License UK?

IYouget six penalty points oin the UK n your driver’s license. The license may be revoked. However, a person can drive again but may have to pass a practical and theory test to get a provisional license.

Are Penalty Points a Criminal Conviction?

No, penalty points are not criminal convictions. If the situation is difficult, there could be a criminal conviction if convicted of a driving offense causing death.

How Long Do Points Stay on Your License For Speeding?

Points can stay on a driver’s license for speeding for a maximum of 4 years.