When it comes to treating conditions such as herniated discs, spinal stenosis, and sciatica, spinal decompression therapy may be an option for those seeking relief. But does Insurance cover this type of treatment? Unfortunately, coverage for spinal decompression therapy varies significantly from one insurance plan to another. Here, we look at what you need to know about whether your policy will cover this treatment.

Does Insurance cover Spinal Decompression in the US?

Most insurance companies in the United States, such as Medicare or Aetna, do not cover spinal decompression therapy. However, some insurance plans may cover lumbar decompression if deemed medically necessary, while the majority consider it an experimental or non-standard treatment and do not provide coverage.

Lumbar decompression surgery is a procedure aimed at relieving pressure on the spinal nerves in the lower back, known as the lumbar region. This surgery is typically recommended for individuals who suffer from conditions like herniated discs, spinal stenosis, or sciatica, which cause compression of the nerves in the spine. The operation involves removing or trimming the tissues pressing on the nerves, such as parts of the vertebrae, discs, or ligaments. Lumbar decompression surgery can reduce pain, numbness, and weakness in the lower back and legs by alleviating this pressure, improving the patient’s overall quality of life.

Lumbar decompression can be medically necessary when non-surgical treatments, such as physical therapy, medications, or injections, have failed to alleviate symptoms caused by nerve compression in the lower spine. Conditions like herniated discs, spinal stenosis, or sciatica can lead to severe and persistent pain, numbness, and weakness in the lower back and legs, significantly impacting a person’s daily activities and quality of life. When these symptoms are severe and unresponsive to less invasive treatments, lumbar decompression surgery may be considered necessary to relieve nerve compression, reduce symptoms, and prevent further neurological damage or deterioration.

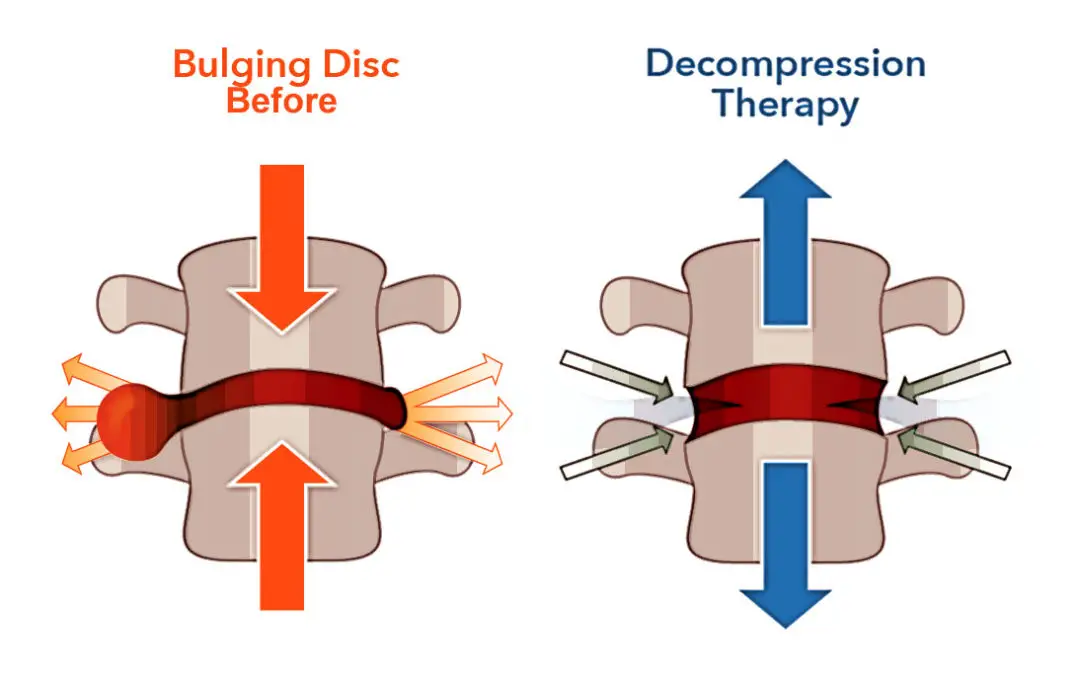

Spinal decompression therapy is a non-invasive procedure involving stretching the spine to relieve pressure off compressed nerves or discs. It is most often used to treat back pain caused by herniated discs, degenerative disc disease, sciatica, and spinal stenosis. Although it should not be used as a substitute for medical advice or treatments prescribed by your doctor, it can help ease pain associated with these conditions and improve your quality of life.

In the United States, coverage for spinal decompression therapy depends on which health insurance provider you are enrolled with and the terms of your particular policy. Generally speaking, most health plans do not cover this form of treatment since it is considered a type of alternative medicine rather than a traditional medical procedure. However, some insurers may provide coverage for certain types of spinal decompression therapies if they are deemed medically necessary—for example, if other treatments have been unsuccessful in providing relief from chronic pain and there is evidence that the procedure could potentially benefit the patient.

It’s important to note that even if your health plan does offer coverage for spinal decompression therapy, you will likely still have to pay out-of-pocket costs such as deductibles or co-pays before any benefits kick in. Furthermore, some providers may only reimburse part of the cost of each session, so read all the details carefully before starting any treatments.

- Spinal Decompression Therapy: A non-surgical treatment designed to relieve pressure on compressed spinal nerves, often used for herniated discs, sciatica, and spinal stenosis.

- Method: It involves stretching the spine using a traction table or similar motorized device to alleviate back or leg pain.

- Insurance Coverage in the US:

- Varies by provider and policy.

- Some insurers may cover it if deemed medically necessary.

- Others consider it experimental or non-standard and do not cover it.

- Examples:

- Aetna labels spinal decompression as experimental and investigational, generally not covering it.

- Coverage might depend on the specific condition treated, like herniated discs or sciatica.

- Alternative Treatments: In cases where Insurance doesn’t cover spinal decompression, physical therapy and chiropractic care might be reimbursed as alternatives.

- Consultation Recommended: Patients are advised to consult their doctors and Insurance companies to understand coverage specifics and explore treatment options.

In addition to traditional health insurance policies, there are also some supplemental plans available through private companies or employers that provide coverage specifically for alternative medicine treatments such as chiropractic services and acupuncture—and these may include some forms of spinal decompression therapy too (be sure to check with your provider). Finally, some states may provide additional protections under their laws requiring specific insurance policies to cover different alternative medicines. Again, it’s best to check with your provider and the state government website before deciding about potential coverage.

Whether or not your health plan covers spinal decompression therapy depends on your policy’s specific terms and where you live in the US. As always, when considering any medical treatment—whether conventional or alternative—, it’s essential to talk with your doctor and insurance provider first to know exactly what is covered under your policy before starting any new treatments.