Table of Contents

Health insurance is an agreement between you and your insurance company, where you pay them a premium, and they agree to cover a portion of your medical costs as laid out in your policy. If you have health insurance, one of the essential pieces of identification you’ll carry is your insurance card. One critical piece of information on this card is the subscriber’s name. This article will delve into what a subscriber’s name is, its importance, and how it affects your healthcare coverage.

What is the Subscriber Name on the insurance card?

The subscriber’s name on an insurance card refers to the person who holds and pays for the insurance policy. They may also be referred to as the policyholder or the insured. The subscriber name is typically the individual’s full legal name, which includes their first name, middle name or initial (if applicable), and last name.

A health insurance policy could cover just the subscriber (individual plan), the subscriber and their spouse (couple plan), or the subscriber and their family (family plan). In family or couple plans, the subscriber is the person whose employment benefits cover the health insurance or the person who directly contracted with the insurance company.

The subscriber is the primary contact with the insurance company, is responsible for premium payments, and receives all official correspondence regarding the policy.

The Importance of the Subscriber Name

The subscriber name is a vital piece of information on the insurance card for several reasons:

- Provider Verification: Healthcare providers use the subscriber name to verify coverage and benefits with the insurance company. This information is crucial for understanding the portion of the medical bill the insurance company will cover, any applicable deductibles, copayments required, and if pre-authorization is necessary for specific treatments.

- Billing: The subscriber’s name is required for billing purposes. When a provider submits a bill or claim to the insurance company, they must include the subscriber’s name to ensure the bill is applied to the correct policy and person.

- Identification: If a family plan covers you, the subscriber’s name differentiates you from the primary policyholder. It distinguishes you from others covered under the same policy, like your siblings or children.

Other Related Information on the Insurance Card

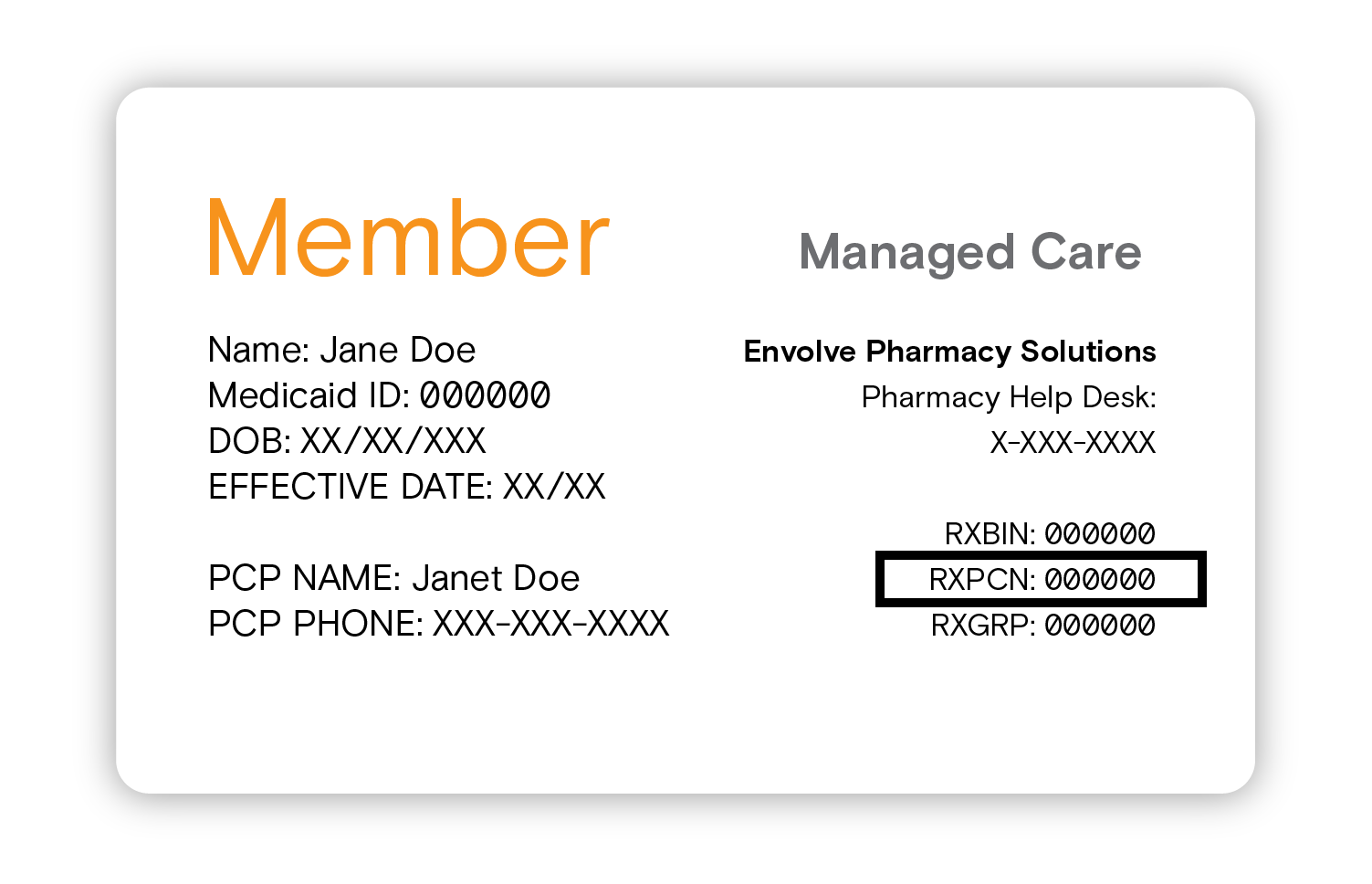

Along with the subscriber name, the insurance card carries other vital information:

- Policy Number: Also known as the subscriber number, this is unique to the policyholder and is used to identify your particular contract with the insurer.

- Group Number: If you receive your insurance through an employer, you’ll likely see a group number. This number pertains to the benefits and coverages your employer has negotiated with the insurer.

- Insurance Company Contact Information: This typically includes a customer service phone number, a website, or an email address where you can reach out with questions or concerns about coverage, claims, or other issues.

- Plan Type: This shows what kind of plan you have, like an HMO (Health Maintenance Organization) or PPO (Preferred Provider Organization). Your plan impacts which providers you can see and what approval you need for specialists or services.

Conclusion

The subscriber name on your insurance card is crucial information that identifies the policyholder, aids in billing, and helps providers verify your coverage. Ensuring this information is accurate is essential to prevent any confusion or delays in your healthcare delivery. If there are changes to the subscriber’s information, such as a name change, the insurance company should be notified immediately to update their records and issue a new card. Understanding the information on your insurance card empowers you to navigate the healthcare system more effectively, ensuring you maximize your benefits and maintain good financial health alongside your physical well-being.