Table of Contents

The clutch engages and disengages the engine from the transmission, allowing the driver to shift gears.

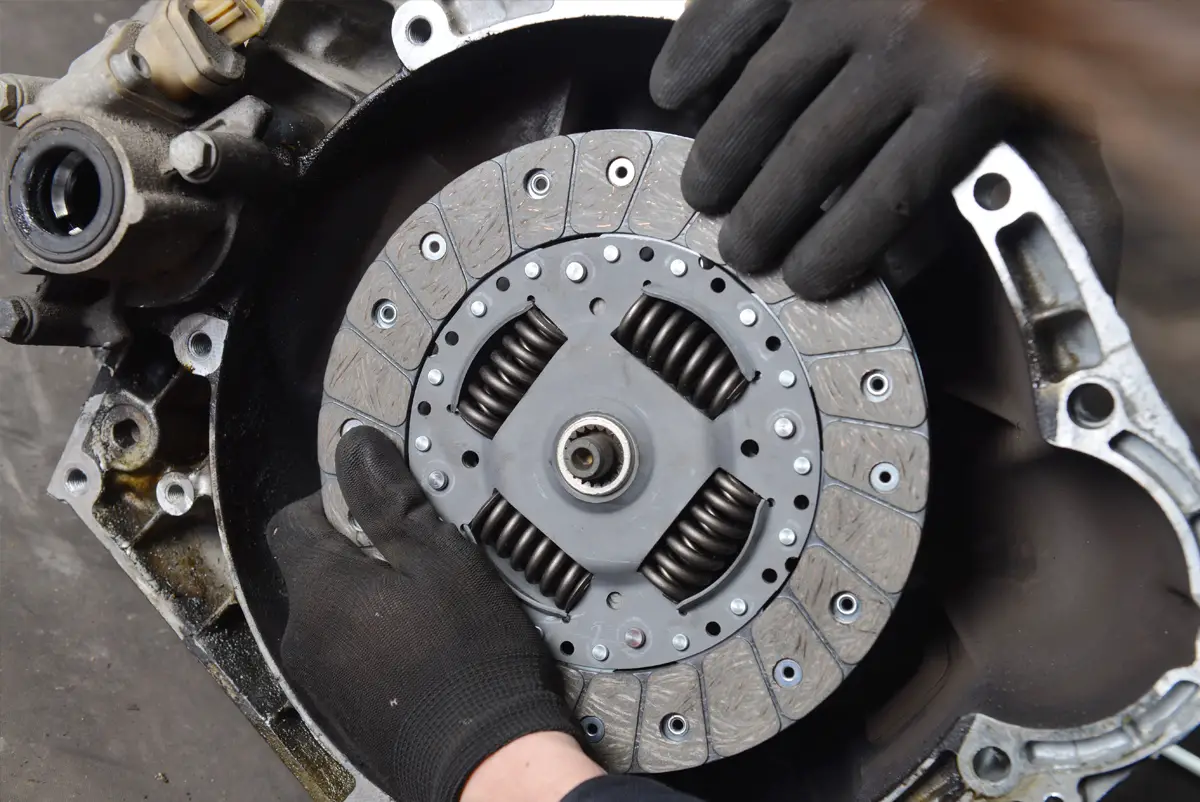

The clutch cover is a metal housing that encloses the clutch assembly and provides protection and support. It is typically bolted to the engine’s flywheel and diaphragm spring, which applies pressure to the clutch disc, which engages the transmission.

A problem with the clutch cover can cause issues with the clutch system, such as slipping, difficulty shifting gears, or a burning smell. In some cases, the clutch cover may need to be replaced to restore proper function to the clutch system.

Does Insurance Cover Clutch Replacement?

In general, most car insurance policies do not cover the cost of clutch replacement because it is part of routine maintenance. However, if the clutch was damaged due to a covered event, such as a collision or theft, your insurance policy may cover the cost of repair or replacement.

Review your insurance policy carefully and speak with your insurance provider to understand what is and isn’t covered under your policy.

If the clutch needs to be replaced due to normal wear and tear, the car owner usually pays for the repair or replacement costs out of pocket.

Clutch replacement is one of the most common issues drivers face when it comes to car repairs. However, the implex job takes time and often requires specialist tools, meaning labor costs can quickly increase.

It’s also essential taste that even if your insurer agrees to pay part of the repair costs, they may not cover all of them. This is because they typically want you to bear some responsibility and cost for wear-and-tear damage caused by everyday driving conditions and lack of maintenance. That being said, if you can prove with receipts or other evidence that you’ve regularly serviced your vehicle and kept up with necessary repairs over time, this could help boost your chances of getting more insurance coverage.

When deciding whether or not a repair bill should be covered, insurers usually look at three main factors: the age of the vehicle, the cause of damage, and service history. If all three are in order – i.e., vehicle age isn’t too high; thereisn’toof that ththere’se was caused by something outside of your control; and service records demonstrate regular maintenance – then, again, there is a greater chance that some portion of the repair bill will be covered by insurance.

Remember that each policy differs, so what one company covers may not be covered under another’s terms and another’s. So before committing to a procedure or filing a claim with your insurer, read through all documentation carefully to know precisely what is and isn’t included in youisn’terage. For example, while some policies may only reimburse parts or labor up to specific amounts (or only when specific criteria are met), others may offer more generous reimbursements on repairs like clutches or transmissions.

Clutch replacement paid by insurance example

Your car insurance policy has a comprehensive collision coverage with a $500 deductible. One day, while driving your car, you are involved in a collision that damages and requires replacing the clutch. The repair shop estimates the cost of clutch replacement to be $1,500.

Here’s how the insuraHere’smpany might handle the claim:

- First, you file a claim with your insurance company, providing details of the accident and the damage to your car, including the clutch replacement cost.

- An adjuster from the insurance company inspects your car to assess the damage and verify that it was caused by a covered event (in this case, a collision).

- The adjuster determines that the clutch replacement is covered and approves the claim.

- The insurance company pays the repair shop directly for the clutch replacement cost of $1,500.

- Since you have a $500 deductible, you would be responsible for paying that amount directly to the repair shop.

In this example, the insurance company covers most of the clutch replacement cost minus the deductible. However, it’s important to notit’sat insurance policies and deductible amounts can vary widely, so it’s always a good idit’so review your policy and speak with your insurance provider to understand your coverage and any out-of-pocket expenses you may be responsible for.

Why is Clutch Replacement an expensive job work?

Clutch replacement is expensive work from $500 up to $3000 that usually is not covered by insurance because of several complicated steps, such as:

- Remove the transmission: The first step in replacing a clutch is to remove the information from the engine. This typically involves disconnecting the driveshaft, electrical connections, and other components that attach the transmission to the engine.

- Remove the clutch assembly: Once the transmission is out of the way, the clutch assembly can be accessed and removed. This involves disconnecting the clutch cable or hydraulic line and unbolting the pressure plate and clutch disc from the flywheel.

- Inspect the flywheel: With the clutch assembly removed, the flywheel should be inspected for signs of wear or damage. If necessary, it may need to be resurfaced or replaced.

- Install the new clutch: The assembly can be installed, starting with the clutch disc and pressure plate. The new parts should be aligned and torqued to the manufacturer’s specifmanufacturer’sstall the transmission: Once the new clutch is in place, the information can be reinstalled and connected to the engine. This typically involves reconnecting the driveshaft, electrical connections, and other components removed earlier.

- Test the clutch: After the clutch replacement is complete, it’s essential to tesit’se grip to ensure it works correctly. This involves starting the engine, engaging and disengaging the clutch, and shifting through the gears to ensure everything operates smoothly.

It’s important to notIt’sat the specifics of clutch replacement can vary depending on the make and model of your car. Additionally, a clutch replacement can be a complex and time-consuming process, so it’s often best to hait’st performed by a qualified mechanic with experience in clutch replacement.

Conclusion

Regardless of where you stand regarding coverage for clutch replacements, it’s important to continually use comprehensive auto insurance if possible, as this offers protection against more incidents. Most comprehensive policies cover injury liability (if someone gets injured due to an incident involving your car), collision (if there was an accident), and other forms of property damage (e.g., someone else’s car). They mayelse’sinclude roadside assistance services like jump starts and flat tire changes, among other benefits – so even if they don’t cover everythindon’tated to clutch replacements directly, having comprehensive coverage will still give you access to added peace of mind when out on the roads.