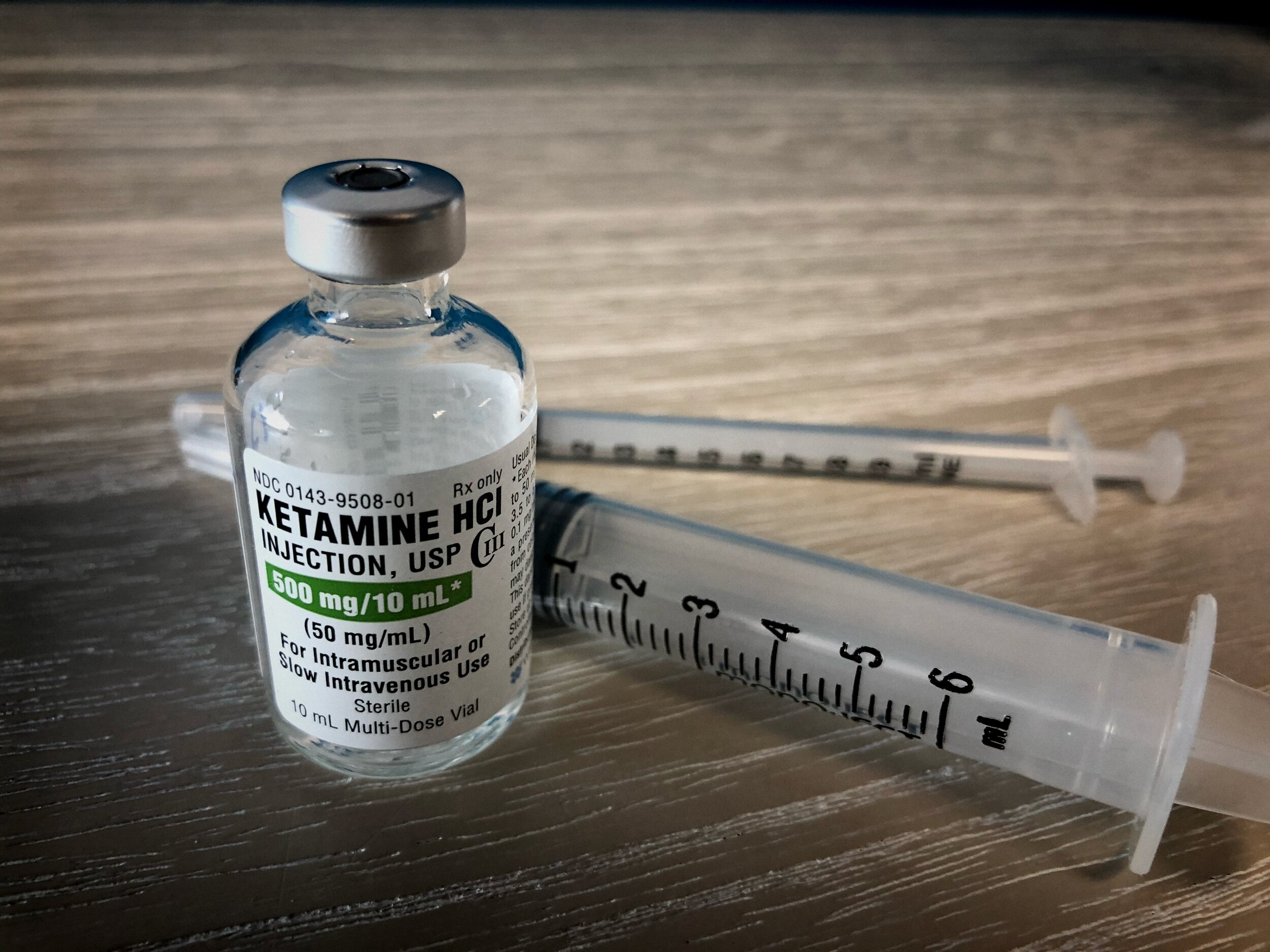

Ketamine infusion therapy is a medical treatment that uses ketamine to treat various conditions, including chronic pain syndromes, severe depression, post-traumatic stress disorder (PTSD), and certain anxiety disorders. It is a promising but still considered a somewhat experimental form of therapy.

Ketamine is an anesthetic drug used for over 50 years in surgeries, mainly for its properties to induce a trance-like state while providing pain relief, sedation, and memory loss. It’s a “dissociative anesthetic” because it can make people feel detached from their environment and themselves. It can also lead to hallucinations, which is why it’s been abused as a recreational drug.

Ketamine infusion therapy is an increasingly popular treatment for mental health issues such as depression and anxiety. It has reduced symptoms, improved quality of life, and provided an alternative to traditional therapies like antidepressant medications or psychotherapy. However, one question that often comes up when looking into ketamine infusion therapy is whether or not it is covered by insurance.

Is Ketamine Infusion Covered by Insurance?

Most insurance plans do not cover ketamine infusion therapy. Ketamine infusion therapy is not yet officially approved and is typically used off-label for conditions like depression and chronic pain. Insurance companies often hesitate to cover it due to this off-label status, its potential for abuse as a street drug, and a lack of standardization in its use for mood and pain disorders.

Ketamine infusion therapy has been used off-label for various conditions, such as severe depression, post-traumatic stress disorder (PTSD), and specific chronic pain syndromes. The term “off-label” refers to using approved drugs in a manner not specified in the FDA’s approved label. This isn’t necessarily bad; many drugs are effectively and safely used off-label. However, because off-label uses haven’t undergone the extensive FDA approval process specifically for those conditions, they may be less standardized, and there might be less comprehensive research backing up their efficacy and safety.

Ketamine’s case is somewhat unique. The drug has been FDA-approved as an anesthetic for many years, but its use for mood and pain disorders is more recent.

Insurance companies typically cover treatments that are FDA-approved and considered standard in the medical community. Because ketamine infusions for mood and pain disorders are not formally FDA-approved and standardized, insurers may be reluctant to cover them. The coverage varies widely, with some insurers offering some coverage and others not covering it.

Furthermore, ketamine has a reputation as a “party drug” or “street drug,” where it is sometimes abused for its hallucinogenic and dissociative effects. This can contribute to stigma and make insurance companies more hesitant to cover it.

Lastly, the cost of ketamine infusion therapy can be high, and without insurance coverage, it may be inaccessible for many patients. This contributes to the perception of ketamine infusions as a treatment of last resort or an experimental treatment.

However, the situation can evolve. As more research is conducted and more positive results emerge, the perception of ketamine therapy and insurance coverage policies could change.

There are some exceptions, however; specific plans may offer coverage for certain forms of ketamine infusion therapy if deemed medically necessary. You must check with your insurer to see if this is the case for your plan.

It should be noted that there are other ways to access ketamine infusion that don’t involve insurance companies; some medical practices offer cash payments or payment plans that make the cost of treatment more affordable. Additionally, many states have passed laws allowing pharmacists to dispense low doses of ketamine for off-label use in treating depression. However, this generally applies only to oral doses and may not be available in all areas.

For those whose insurance does provide coverage for ketamine infusions, there are still a few hurdles to overcome. Insurance companies often require preauthorization before covering the treatment, meaning you must get the company’s approval before receiving care. Additionally, providers must meet specific criteria set out by insurers—for example, they may require documentation from your doctor detailing why you need the treatment—to cover the service.

It’s also important to note that even if a particular insurer does cover a specific form of ketamine infusion therapy, it doesn’t guarantee that every provider offering this type of care will be able to accept your insurance plan or meet the coverage requirements set forth by your carrier. It pays to shop around and compare different providers to find one who meets your needs and your insurer’s.

Of course, no two people are exactly alike. Hence, it’s always best to contact your insurer directly before pursuing any type of medical treatment—especially one as unconventional as ketamine infusion therapy—to find out exactly what types of coverage are available under their policies. This way, you can ensure that you have enough information before deciding whether or not this type of treatment suits you and how best to pursue it financially.