Myofunctional therapy is a treatment that focuses on improving the function and use of the muscles of the mouth, face, and throat, particularly those involved in swallowing, chewing, and resting postures. The process typically consists of exercises that help to retrain these muscles, fostering proper tongue positioning, improved breathing, and correct swallowing and chewing mechanics. Over time, these exercises can correct dysfunctional habits, alleviate related health problems, and even alter facial growth in children. Therapy is usually customized to individual needs and requires consistent practice to achieve and maintain results.

Myofunctional therapy effectively treats sleep-related issues, speech impediments, and other mouth-related problems. As this type of therapy’s popularity grows, many ask if Insurance covers it.

Does Insurance cover Myofunctional Therapy?

No, usually, Myofunctional Therapy is not Covered by Insurance because it is considered an out-of-pocket expense. Myofunctional therapy is often categorized as speech or physical therapy, and many insurance companies don’t cover therapies that are not seen as” medically necessary.”

Myofunctional therapy is a program used to correct improper function of the tongue and facial muscles used at rest, for chewing, and for swallowing. Many of the exercises used in myofunctional therapy are similar to those used in particular speech and physical therapies, as they teach patients to use their muscles differently. This is what’s often categorized with these types of therapy’s a closer look at each connection:

- Speech Therapy: Myofunctional therapy often addresses issues related to ttongue’se’s positioning and movement, which can significantly affect speech. For instance, a tongue thrust (when the tongue pushes against or between the teeth during speech) can cause a lisp or other speech problems. Many speech therapists are trained in myofunctional therapy and incorporate its techniques into their treatment plans.

- Physical Therapy: Like physical therapy, myofunctional therapy involves exercises that improve the function and strength of specific muscles – in this case, the muscles of the face and mouth. This includes teaching patients how to properly position their tongue at rest, how to swallow correctly, and how to breathe through their nose rather than their mouth.

Regarding insurance coverage, myofunctional therapy can sometimes be gray. Many insurance companies provide coverage based on a treatment that is” medically necessary”y. This usually means that the treatment must be used to diagnose or treat an illness, injury, condition, disease, or its symptoms and that it meets accepted standards of medicine.

Because myofunctional therapy is often used to address conditions that may not be classified as medical conditions (like certain types of speech disorders or habits like thumb sucking), it may not be considered “d “medically necessary” under the terms of many insurance policies. The efficacy of myofunctional therapy is still a topic of ongoing research. Its acceptance as a valid and necessary treatment option can vary among medical professionals, further complicating coverage determinations.

However, there may be exceptions based on patients’ specific medical needs and the terms of their insurance policy. For example, if myofunctional therapy is needed due to a specific health condition or medical procedure, some or all of the therapy may be covered. Additionally, if the therapy is performed by a provider within the patient’s insurance network, there may be some coverage.

Here are a few steps that can help determine whether Myofunctional therapy is covered:

- Check with the insurance provider: The patient or their guardian should ask about coverage directly with their insurance provider. Specific codes from the healthcare provider for the myofunctional therapy treatments can be helpful, as the insurance provider can use these to determine their coverage policies.

- Getdoctor’sr’s recommendation: If a doctor recommends the therapy as part of a treatment plan for a covered medical conditioit’st’s more likely to be covered. In this case, the doctor can help provide documentation to support the medical necessity of the therapy.

- Document symptoms and improvements: Keeping a log of symptoms and improvements can help make a case for the necessity of the therapy. This can be especially helpful if an appeal needs to be made to the insurance company.

- Explore out-of-network benefits: Even if the therapy provider is not in tpatient’st’s insurance network, out-of-network benefits may provide some coverage.

Speaking directly with insurance and healthcare providers about specific coverage questions is crucial. It’s also important to remember that insurance policies can vary greatly, so what applies to one patient may not apply to another.

Myofunctional Therapy Covered By Insurance

Insurance coverage for physical therapy (myofunctional therapy) can vary significantly based on the type of insurance plan, the specific policy details, and the medical necessity of the therapy. Here are the typical types of insurance plans and how they generally handle physical therapy coverage:

- Health Maintenance Organization (HMO): These plans often cover physical therapy but usually require a referral from a primary care doctor. They also frequently require that the treatment be provided by a therapist in tplan’sn’s network. Copays may apply.

- Preferred Provider Organization (PPO): PPO plans often cover physical therapy. They generally allow for more flexibility in choosing a therapist adon’tn’t necessarily require a referral. However, seeing an in-network therapist will usually result in lower out-of-pocket costs.

- Medicare: Medicare Part B (medical Insurance) typically covers medically necessary physical therapy a Medicare-approved therapist provides. The amount of therapy covered per benefit period may be limited may be limited.

- Medicaid: Medicaid coverage for physical therapy can vary by state, but most state programs provide some coverage for medically necessary physical therapWorkers’rs’ Compensation Insurance: If a person needs physical therapy due to a work-related injury or illness, it should be covered workers’rs’ compensation insurance.

- Auto Insurance/Personal Injury Protection (PIP): If physical therapy is needed due to an auto accident, it may be covered by auto insurance under a PIP or medical payments (MedPay) policy.

- Private Insurance: Many private insurance plans also cover physical therapy. The extent of the coverage can vary widely, depending on tplan’sn’s specifics.

In general, coverage will depend on the specifics of the insurance policy, including any deductibles, copayments, coinsurance, out-of-pocket maximums, and coverage limits or caps. It also often depends on whether the therapy is considered medically necessary and prescribed by a doctor. Prior authorization may be required.

To get the most accurate informatioit’st’s always a good idea to check directly with your insurance provider employer’sr’s benefits administrator to understand what your specific plan covers.

Typically, insurers will only cover Myofunctional therapy if you can proit’st’s medically necessary to treat a diagnosed condition such as childhood speech delay or sleep apnea. Even then, there may be restrictions and limits on how much money they will pay for the therapy. Furthermore, some insurewon’tn’t cover any part of the cost if ydon’tn’t see a licensed professional specializing in myofunctional therapy.

You still have options if your health plan does not currently offer coverage for myofunctional therapy services. Many companies offer dental discount plans, which can provide up to 50% discounts on specific treatments when you visit their network providers. Additionally, many providers work with patients on a sliding scale fee system based on income level and other factors that make treatment more affordable.

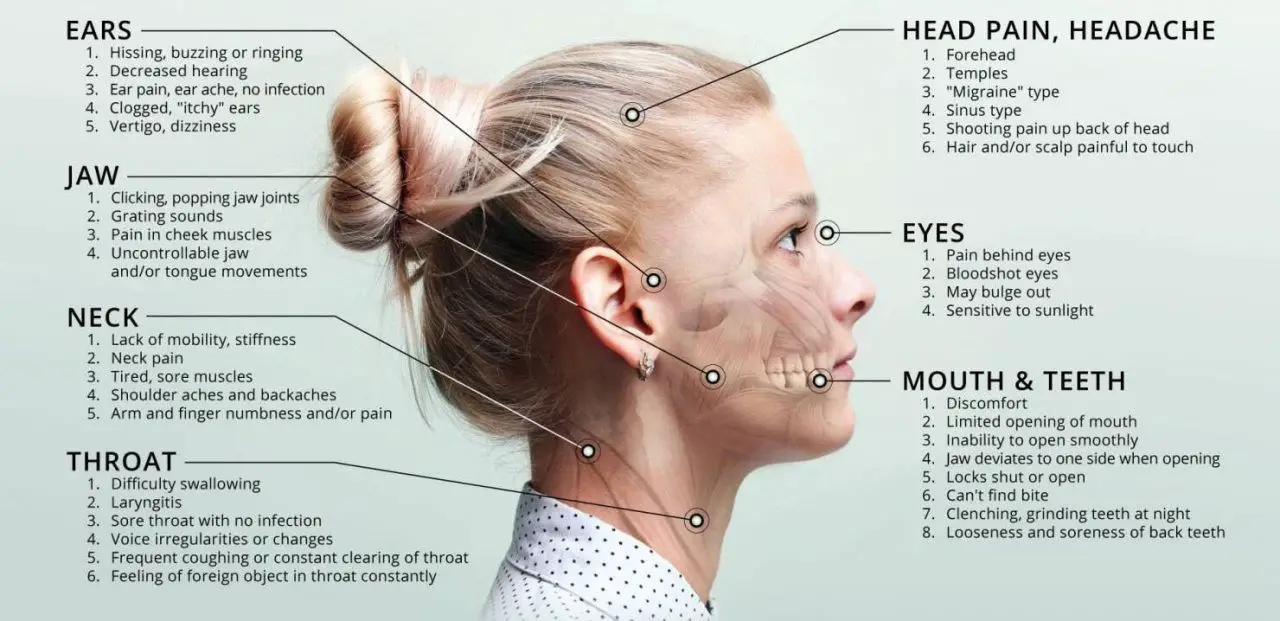

Myofunctional therapy has proven effective in treating many conditions related to the mouth and breathing throughout life, including infancy and adulthood – from childhood speech delays and sleep apnea through teenage orthodontics and adult TMJ dysfunction. If you think this type of therapy could help improve your quality of life or treat an existing problem, speaking with your doctor or dentist about whether it might be right for you would be the best first step in exploring further options regarding insurance coverage.