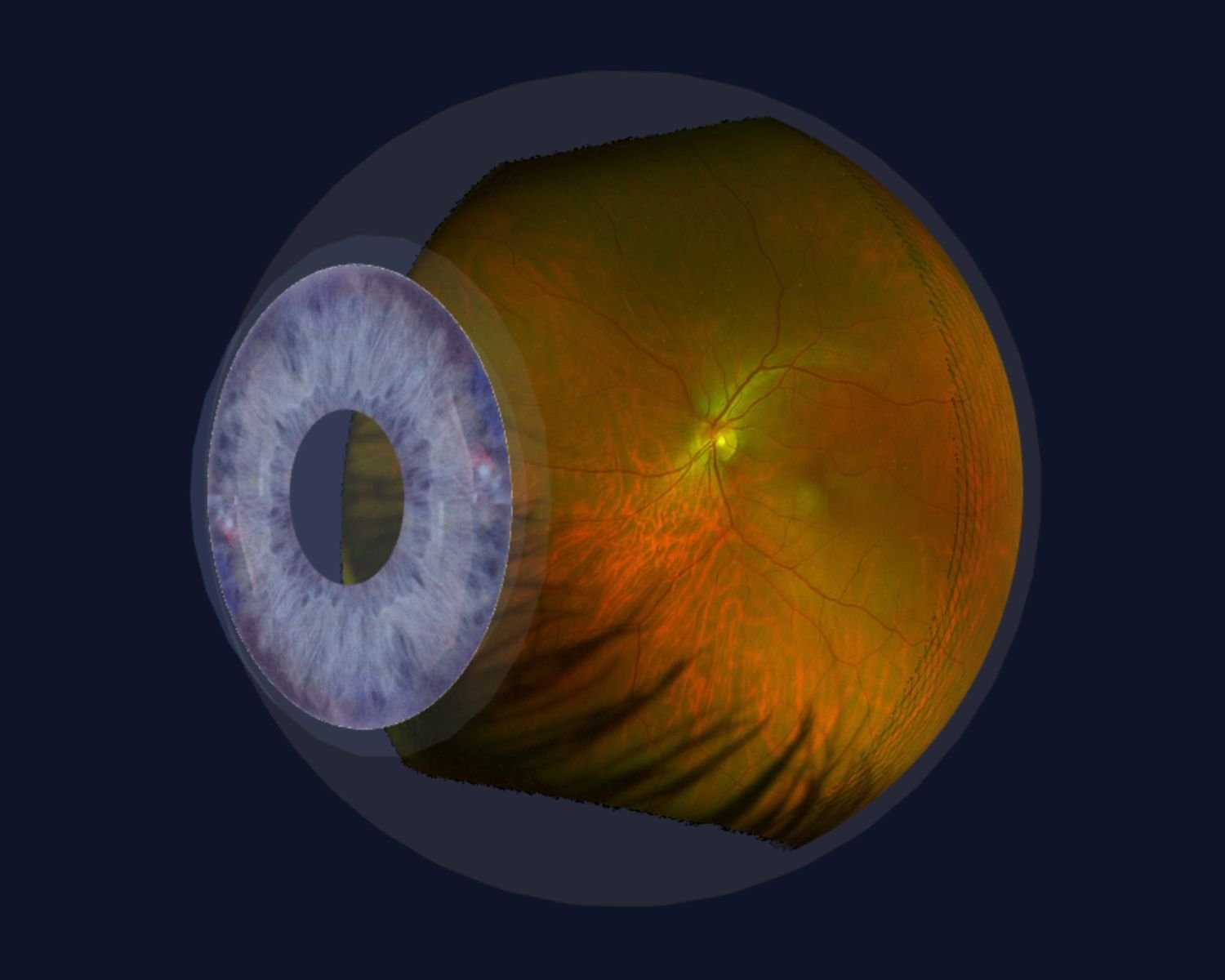

The Optomap is an advanced eye examination technology that captures a detailed, ultra-widefield image of the retina. This technology allows eye care professionals to view up to 82% of the retina in a single image, compared to traditional methods that typically reveal only 15-45%. The Optomap exam is quick, painless, and does not require dilation of the pupils in most cases. It is precious for early detection and treatment of various eye conditions such as retinal detachment, glaucoma, and age-related macular degeneration.

Why is Optomap Not Covered by Insurance?

Optomap exams are often not covered by insurance because they are considered non-essential or supplementary to standard eye care. Additionally, the higher cost of Optomap technology compared to traditional eye exams and varying policies among insurers regarding coverage of newer medical technologies contribute to its limited insurance coverage.

The coverage of Optomap exams by insurance varies depending on the insurance provider and the specific plan, but there are several reasons why it might not be covered:

- Considered Non-Essential or Supplementary: Insurance companies often categorize specific procedures or tests as non-essential or supplementary, especially if they are not considered standard or necessary for basic eye health assessments. The Optomap, a more advanced and specialized technology, may fall into this category.

- Lack of Universal Recognition: While the Optomap provides a comprehensive view of the retina and can aid in the early detection of eye diseases, it may not yet be universally recognized by all insurance companies as a standard diagnostic tool in eye care.

- Cost Factors: Optomap exams can be more expensive than traditional retinal exams. Insurance companies might limit coverage to less costly procedures to control costs unless a more expensive method is deemed medically necessary.

- Variable Medical Necessity: Coverage often depends on the perceived medical necessity of a procedure. If the Optomap exam is considered elective or for routine screening without specific symptoms or risk factors, insurance may not cover it.

- Differing Policies Among Insurers: Each insurance company has policies and guidelines for what is covered. Some may cover Optomap exams under certain conditions, such as for patients with high risk for eye diseases, while others may not.

- Recent Technological Advancement: As a relatively new technology, some insurance plans might not have updated their coverage policies to include Optomap exams. Over time, as the technology becomes more standard in eye care, insurance coverage might expand.

Many insurance companies don’t view Optomap as essential to a comprehensive eye exam. Since Optomap does not replace or substitute for other tests used to evaluate vision health, such as refraction and visual acuity testing, some insurers are hesitant about covering it. Additionally, Optomap provides more information than necessary to diagnose many common eye diseases and thus may be viewed as redundant or unnecessary from an insurance company’s point of view.

The cost associated with Optomap also fuels insurers’ reluctance to cover it. Although it has been proven effective in detecting various ocular conditions, the price per scan can be relatively high compared to traditional methods. As a result, insurers are often unwilling to pay for Optomap exams when they could invest their resources in more cost-effective strategies like regular comprehensive eye exams instead.

The Optomap technology, known for providing ultra-widefield images of the retina, can be medically necessary in several scenarios related to diagnosing internal eye problems:

- Diabetic Retinopathy: In patients with diabetes, the Optomap can be crucial for monitoring and diagnosing diabetic retinopathy, a condition in which high blood sugar levels damage blood vessels in the retina.

- Retinal Detachment or Tears: The comprehensive view offered by the Optomap is beneficial in detecting retinal tears or detachments, conditions where the retina pulls away from its normal position, requiring immediate medical attention.

- Age-Related Macular Degeneration (AMD): For patients at risk of or showing symptoms of AMD, the Optomap can help in early detection and monitoring of changes in the macula, the part of the retina responsible for clear central vision.

- Glaucoma: Although primarily diagnosed through intraocular pressure measurement and visual field tests, the Optomap can assist in observing changes to the optic nerve and retinal nerve fiber layer, which are crucial in managing glaucoma.

- Peripheral Retinal Pathologies: Traditional methods might miss peripheral retinal lesions. The comprehensive view of the Optomap enables early detection and management of peripheral retinal pathologies.

- Vascular Abnormalities: Conditions like hypertension or other vascular diseases can affect the retina’s blood vessels. The Optomap allows for a detailed examination of these vessels.

- Uveitis and Other Inflammatory Conditions: In cases of intraocular inflammation, such as uveitis, the Optomap helps assess the extent of inflammation and monitor treatment efficacy.

- Symptomatic Patients: For patients experiencing symptoms like flashes, floaters, or sudden vision changes, the Optomap provides a thorough retinal evaluation to rule out serious issues.

- Pediatric Patients: Children who might not tolerate traditional dilated fundus examinations well can benefit from the quick and non-invasive nature of the Optomap.

- Patients Unable to Undergo Dilation: In some cases where pupil dilation is not advisable or possible, the Optomap offers an alternative means of examining the retina comprehensively.

- High-Risk Patients: Individuals with a family history of retinal diseases or other risk factors for eye conditions may require more thorough retinal examinations like those provided by the Optomap.

In addition to these factors, some insurance companies are wary about covering Optomap because there is a lack of evidence supporting its use for detecting certain conditions like glaucoma or age-related macular degeneration (AMD). While studies have demonstrated that Optomap can detect changes associated with AMD progression earlier than conventional methods, further research is needed before most insurance companies consider covering it as part of routine exams.

Finally, another primary reason why most insurance plans do not cover Optomap is that it requires specially trained personnel who understand how to interpret the images produced by this technology correctly. Without proper training and understanding of how to read and use these images effectively in clinical practice, many insurers don’t feel comfortable providing coverage for this service.

Overall, while Optomap has been shown to provide valuable insights into different ocular diseases that would otherwise be undetectable through other diagnostic tools such as conventional fundus photography or optical coherence tomography (OCT), several factors still prevent most insurance companies from covering it as part of routine eye exams. These include its cost relative to other options available for diagnosing vision problems, the lack of evidence supporting its efficacy, and the need for specialized personnel to interpret image results before correctly making treatment decisions.