Table of Contents

Many people are unaware of the plethora of coverage options available when it comes to homeowners insurance. Truss uplift insurance is one such option you may not have heard of. This type of coverage protects against damage caused by the natural force of gravity, which can cause a roof truss to become detached from the walls or ceiling of a home due to extreme external forces such as wind or hail.

What is Truss uplift?

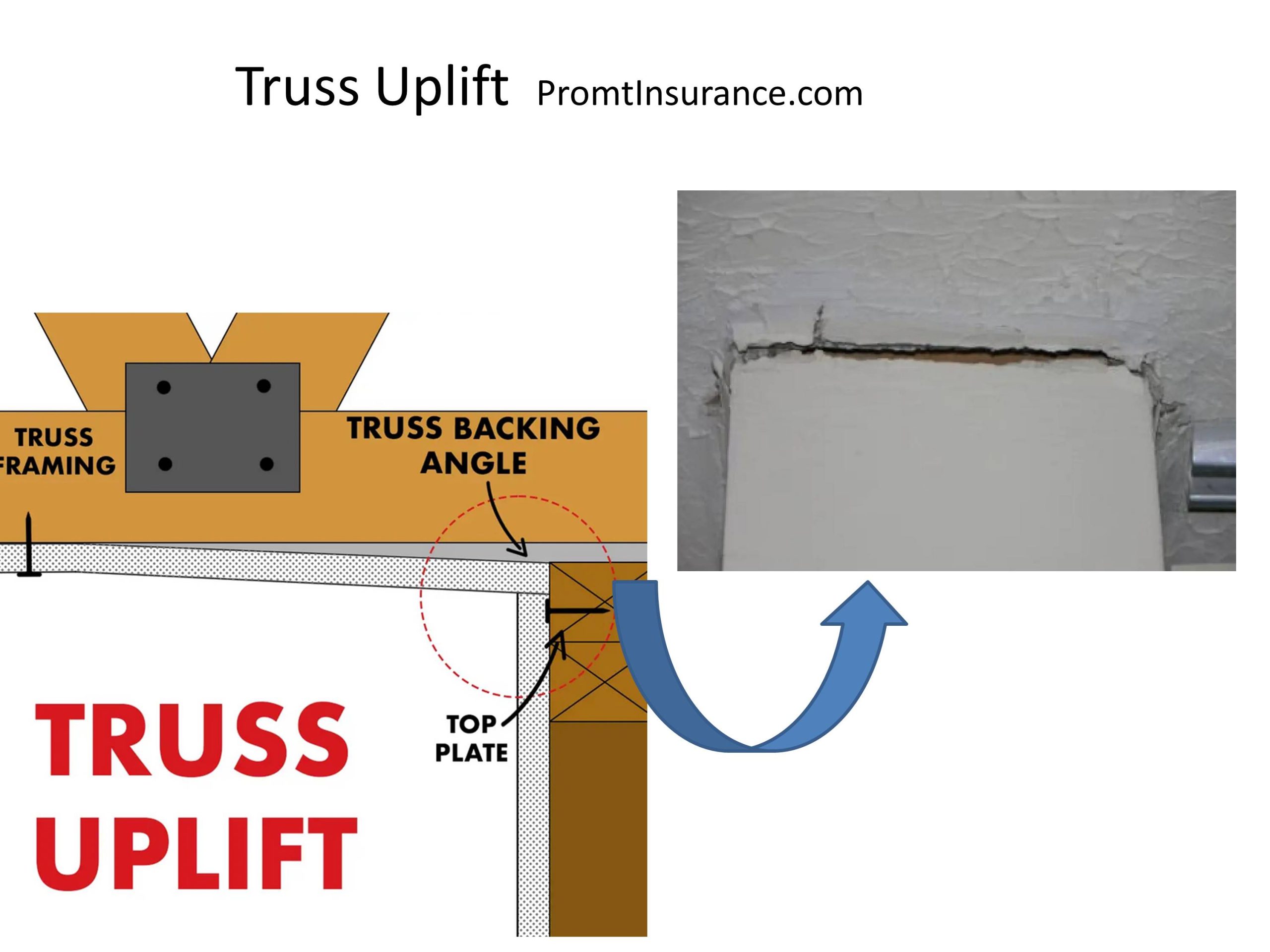

Truss uplift is a phenomenon that can occur in homes that are built using roof truss systems. It happens when the bottom chord of a roof truss expands and contracts differently than the rest due to differences in humidity and temperature between the attic and the living spaces below.

Here’s how it works:

- Roof trusses are typically triangular, with the two top chords (the sides of the triangle) meeting at the roof’s peak and a bottom chord (the triangle’s base) running parallel to the ground.

- In winter, the top chords of the truss are exposed to cold attic air, while the bottom chord is exposed to warm air from the living spaces below. This can cause the bottom chord to expand while the top chords remain relatively stable.

- As the bottom chord expands, it can cause the entire truss to lift, causing a visible gap between the interior walls and the ceiling. This is referred to as truss uplift.

- In the summer, as the attic heats up and the humidity decreases, the bottom chord can contract again, and the truss may return to its original position.

Truss uplift is not a structural concern but can cause cosmetic issues. For example, it can result in cracks in the drywall at the corners of the walls and ceiling or make the walls appear to be lifting off the ground.

To avoid the appearance of truss uplift, builders can use several strategies, such as using special clips to attach the drywall to the trusses that allow for some movement or not securing the drywall to the truss within a certain distance of the interior walls. Also, molding can be installed to remain attached to the ceiling but can move upward with the truss, thus hiding the gap from view.

Is Truss Uplift Covered By Insurance?

Truss uplift, a natural phenomenon where the roof truss lifts or moves due to seasonal changes, typically isn’t covered by standard homeowners insurance because it’s considered a matter of home maintenance, not an unexpected peril. Homeowners’ insurance policies can cover truss uplift only if you prove that sudden and accidental damage is caused by fire, theft, or weather-related events.

To understand how truss uplift coverage works, it is essential to understand what a roof truss is and why it needs coverage in the first place. A roof truss is an engineered beam constructed from metal or wood and includes several connected triangles forming one large triangle structure. This structure then supports the roofing system and stabilizes the entire building. Without this structure, roofs can become structurally unsound and collapse during severe weather events such as hurricanes or tornados.

Truss Uplift is a structural engineering technique that aims to increase the strength of building components such as walls, columns, and beams by adding additional support. This approach can make structures more resistant to storms, floods, and earthquakes.

Truss uplift occurs when vertical loads are applied to an upper part of a truss structure, such as roofs or walls, that causes the bottom portion of the truss to lift off the ground. The uplift force can be increased by adding bracing elements like cables or bolts that tie the bottom and top sections together. This will create tension between these two sections and prevent further displacement from occurring.

When can insurance cover Truss Uplift?

Your homeowner’s insurance could potentially cover truss uplift in the following scenarios:

- If it’s caused by sudden and accidental damage from events such as:

- Fire

- Theft

- Weather-related events like storms, hurricanes, or tornadoes

- If the truss uplift indirectly leads to other problems that are covered by your policy, such as:

- Mold growth

- Pest infestation

If truss uplift indirectly results in other issues like mold growth or pest infestation, these resultant damages could potentially be covered by your homeowner’s insurance, as these are often classified as unexpected perils, depending on the specifics of your policy. Insurance policies differ significantly, so it’s essential to understand your coverage. Always review your insurance contract thoroughly or discuss with your insurance representative for accurate information on what is and isn’t covered.

If truss uplift is caused by covered perils such as fire, theft, or weather-related events, your homeowner’s insurance would typically cover the cost of repair or replacement. For example, if a fire damaged the trusses, causing them to lift, or a weather event such as a tornado or hurricane caused damage leading to truss uplift, these instances would likely be covered. However, it’s always recommended to carefully review your specific insurance policy or consult with your insurance provider to understand the extent of your coverage.

You should review your policy or consult your insurance provider to confirm what is covered, as policies vary.

Truss uplift insurance covers any damage caused by a roof truss becoming detached from its anchors due to natural forces like wind and hail. Suppose a windstorm causes your roof to detach from its anchors due to excessive gusts. In that case, your insurer will cover any property damage and any repairs necessary for reinstalling the trusses securely back into place. The amount covered varies depending on your policy. Still, it typically includes costs related to structural repair, new shingles, labor charges for installation or repair work, replacement rafter ties or straps, replacement plywood sheathing or panels, and other materials required for permanent repairs. In some cases, insurers may even cover re-roofing costs associated with damaged shingles caused by solid winds if necessary for safety reasons.

If you own a home with a flat roof, you should also be aware that most traditional homeowners’ policies do not offer coverage for damages from flat roofs being lifted due to heavy winds. However, some insurers may offer separate flat-roof coverage at an additional cost if they deem your home prone to such risks due to its location and climate conditions in your area.

Truss uplift insurance provides homeowners with added peace of mind, knowing that their home investment is protected in case disaster strikes unexpectedly due to powerful winds and storms tearing through their area without warning. All homeowners should review their current insurance policies closely with their agents to ensure they are adequately covered before severe weather season arrives each year so that they may be able to acquire additional protection if necessary for better overall financial security when unexpected disasters strike unexpectedly close to home.